Of the three regional surveys released to date for May, all show manufacturing expansion.

GROWTH IN TENTH DISTRICT MANUFACTURING ACTIVITY EXPANDED SOLIDLY

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity expanded solidly, and producers’ expectations for future factory activity remained at healthy levels.

“This was the third straight month of solid growth at factories in the region, following some weather-related weakness in previous monthsâ€, said Wilkerson. “More factories than in recent surveys were also able to raise selling prices.â€

TENTH DISTRICT MANUFACTURING SUMMARY

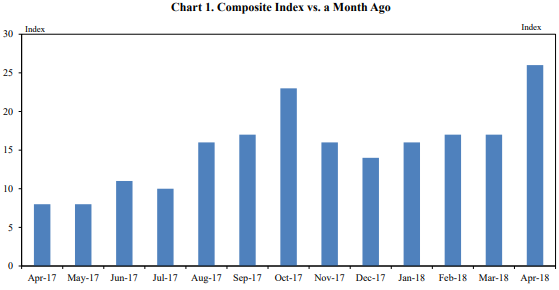

Tenth District manufacturing activity expanded solidly in May, and producers’ expectations for future factory activity remained at healthy levels. Most price indexes increased somewhat, particularly current selling prices.

The month-over-month composite index was 10 in May, up from 7 in April and equal to 10 in March. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing activity improved slightly at most durable goods-producing plants, particularly for machinery and construction materials, but remained mostly flat for non-durable products. Other month-over-month indexes were mixed. The production index inched higher from 12 to 14, and the new orders and employment indexes also rose. In contrast, the shipments index fell from 14 to 5, and the order backlog and new orders for exports indexes also decreased. The raw materials inventory index increased from -1 to 11, and the finished goods inventory index also edged up.

Future factory indexes slowed somewhat in May but remained at healthy levels. The future composite index dropped from 21 to 13, and the future production, shipments, and new orders indexes also eased. The future order backlog index decreased from 20 to 9, and the future employment index also edged down. The future capital expenditures index remained solid following a strong rebound in April. The future finished goods inventory index rose from 0 to 2, while the future raw materials inventory index was unchanged.

Most price indexes increased for the second straight month. The month-over-month raw materials price index moved from 21 to 28, and the finished goods price index jumped from 2 to 14, its highest level in nearly three years. The year-over-year raw materials index increased from 59 to 65, and the finished goods price index also increased. The future raw materials price index rose from 46 to 53, while the future finished goods price index was basically unchanged, indicating the same number of firms plan to pass recent cost increases through to customers.