It was just last Friday when we updated our list of the most hated, i.e., most shorted, stocks which are so critical in the New Normal because as we have reported constantly since 2012, going long the most shorted names remains the best alpha-generating strategy, outperforming the broader market by orders of magnitude. Today, it is Bloomberg’s turn to recap just how broken the market is with an article that highlights the “balance sheet bombs” rallying by 94%. The lede: “In the U.S. equity market, the worse a company’s finances, the better it’s doing.” Because there is nothing like rewarding failure and capital misallocation to promote economic growth and employment recovery.

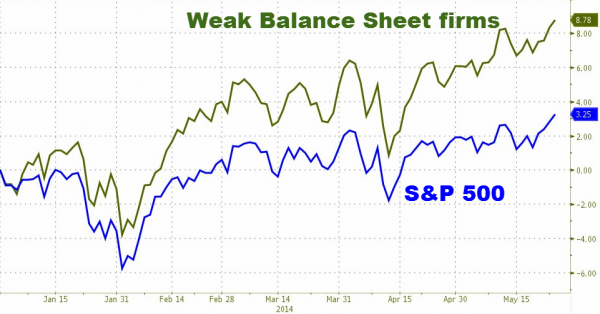

Here is what the outperformance of garbage companies looks like:

Regular readers will know the story but here it is once again because it somehow manages to get funnier with every read:

Stocks with the weakest balance sheets have climbed more than 8 percent in 2014 and 94 percent since the end of 2011, generating almost twice the gain in the Standard & Poor’s 500 Index (SPX) over that period, according to data compiled by Bloomberg and Goldman Sachs Group Inc. Shares in the category this year are beating those that most investors consider the bull market’s leaders, such as small caps and biotechnology, which tumbled in March.

Goldman, whose year end S&P price target is 1900 and which see the S&P at 1950 not on Friday but on June 30, 2015, adds the following value:

“Having a weaker balance sheet isn’t a liability or a drag on potential company performance at this point,†David Kostin, chief U.S. equity strategist at New York-based Goldman Sachs, said in a May 20 phone interview. “In an economy that’s getting better, you can operate perfectly fine with a little more leverage.â€

And here is why we periodically update our list of 50 most shorted stocks: