What does the slow recovery in housing construction tell us about this so-called economic recovery?

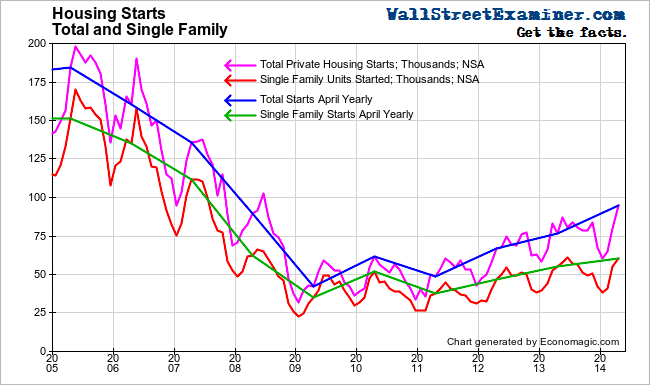

The slow rate of recovery in housing construction is illustrated in the above graphic by Lee Adler. I think it is the canary in the mine for the U.S. and signifies a major area of vulnerability.

There have been some recent articles on the slowdown in growth of the housing sector.

I covered some of this in my recent article.

What is clear is that we have not had a true recovery of the housing market. There has been some recovery but a significant percentage is investor activity, either speculation or taking advantage of the predicament of many people and providing rental opportunities for those who can not qualify to buy a house or are reluctant to do so.Â

There are demographic reasons. There are income distribution reasons. Large expensive houses are selling. Starter houses are not. This unbalanced nature of the housing recovery indicates problems of sustainability of the overall economic recovery. I pay more attention to new construction rather than sale of existing housing and commercial real estate simply because the sale of existing structures does not have the same impact on the economy as new construction.Â

One of many problems relates to the ability of young people to fully participate in the economy. We have taken many actions to complicate the lives of our youth including prematurely raising minimum wages and turning our schools into propaganda factories rather than educational facilities. So we have people who are at the age when they would normally be forming households and buying houses but are instead living at home or renting.Â

Imagine what will happen to the housing industry if interest rates begin to increase. This would lead to another financial crisis only this time it would have a larger component of underwater rental housing and rental apartments. This could have more impact even than the prior collapse because a bank owning housing where the borrower is living in the house might prefer allowing the borrower to stay in the house and maintain it. But a rental landlord has out of pocket expenses in addition to debt service and may have few if any legal protections from foreclosure so they may be more vulnerable. On the other hand, banks may not be equipped to provide services to renters. So there is a lot of potential for such a situation to develop even more quickly than the prior crisis.