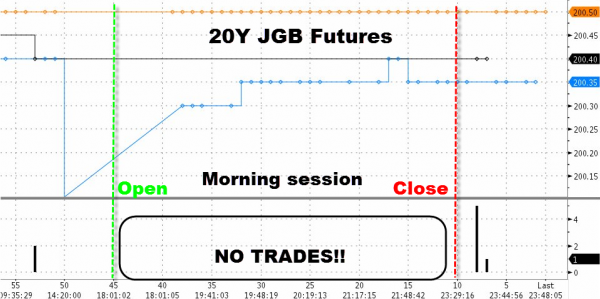

You know things have got a little too strange when the largest government bond market in the world saw no futures trades in the morning session last night. We may complain in the US of falling volumes but none, zero, zip, nada is about as low as it gets; and that is how many trades occurred in the 20Y futures contract in Japan (and 10Y cash bond market). This is not the first time as Mizuho warned in Nov 2013 that “to all intents and purposes, there is no JGB market.” And this lack of trading on a day when major macro data printed far worse than expected… well played Abe… you entirely broke your bond market.

As Bloomberg reports, 10yr cash bond and 20-year bond futures were untraded in the morning session (Japan’s benchmark 10-yr note had no trade all day on April 14; that was the first time since Dec. 2000)

And this total lack of trading occurred on a day when Japan’s Services sector data collapsed 5.4% (considerably worse than expected) as the post-tax-hike hangover hit like a Tsunami…

Mizuho warned in Nov 2013

“The JGB market is dead with only the BOJ driving bond prices,â€Â said Tetsuya Miura, the chief bond strategist at Tokyo-based Mizuho, one of the 23 primary dealers obliged to bid at government auctions. “These low yields are responsible for the lack of fiscal reform in the face of Japan’s worsening finances.Policy makers think they can keep borrowing without problems.â€

“The BOJ’s priority is to lower Japan’s real interest rates and ensure an end to deflation, even if they have to sacrifice liquidity and trading volumes in the bond market,â€

“Market functions are sacrificed for the sake of ending deflation,â€Â said Izuru Kato, the Tokyo-based president of Totan, a research unit of money-market broker Tokyo Tanshi Co. A reduction in monetary stimulus could cause a drop in bond prices, which “will make it difficult for the BOJ to normalize policy,†he said.

“Liquidity has evaporated as the BOJ has gobbled up most of the market,†Nicholas Spiro, the London-based managing director of Spiro Sovereign Strategy, wrote in an e-mail. “To all intents and purposes, there is no JGB market.â€