Remember when we reported that if it wasn’t for Obamacare, the US economy would have contracted not by 1% as per the revised GDP estimate but by 2%. Guess what: according to the latest spending data, the BEA massively overestimated spending on medical care services, which it had pegged at a whopping +9.7% SAAR, while according to the latest Quarterly Services Survey, the increase was actually a decrease of 5.8% SAAR! End result: one after another bank today has sprung to revise their GDP data downward, by about half a percentage point, and here is JPM, cutting its Q1 GDP from -1.1% to -1.6%, which if realized will be the worst collapse in US economic growth since the recession.

It’s ok though:Â the winter was really strong. And the good news: since Q1 is now the “kitchen sink” quarter in which all bad news will be dumped, it simply means that the Obamacare “boost” instead of hitting Q1 where its impact is largely lost, will simply be “pushed” to Q2 and onward. Which also means that US GDP will magically from nearly -2% in Q1 to something approaching +4% in Q2. Batteries and unicorns not included.

Here is JPM.

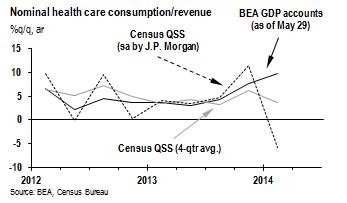

We believe the 1Q Quarterly Services Survey (QSS) implies that there will be a pretty significant downward revision to 1Q GDP growth. Nominal revenue for selected health care services increased 3.3% oya in the QSS, while nominal consumption of medical care services increased 6.1% oya, according to the BEA’s GDP report from May 29. The quarterly changes in the data show an even starker contrast—health care revenue dropped 5.8% saar in the 1Q QSS (using our own seasonal adjustment) while the BEA had previously reported that health care consumption increased 9.7% saar, with this increase largely based on assumptions related to the implementation of the Affordable Care Act.

As we mentioned yesterday, there is some uncertainty about how the BEA will incorporate the QSS data into its estimate of health care consumption in the GDP accounts, but it looks like there could be a significant downward revision to health care consumption in 1Q which would make the health care data more in line with most of the other components of GDP which looked weak in the first quarter. The QSS data also imply some modest upward revisions to some of the other components of services consumption, and very little change to the data on intellectual property products investment, but overall, we think that 1Q GDP growth could be revised down by around half a percentage point because of data contained in the 1Q QSS (but the downward revision could be much larger depending on the BEA’s interpretation of the data). We will look to the BEA for more guidance about its treatment of the QSS data in 1Q, but for now, we are taking our tracking estimate of real GDP growth in 1Q down from -1.1% to -1.6% saar.