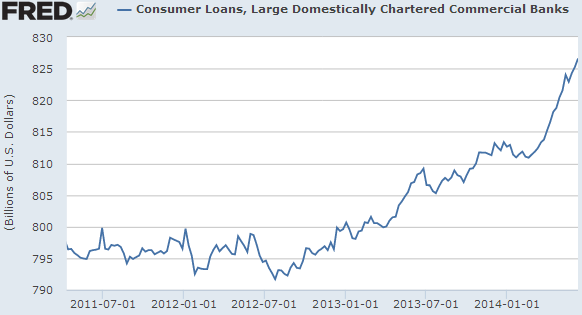

The pace of US consumer credit expansion remains brisk. A quick look at consumer loan balances at large US commercial banks shows a spike that started in February of this year.

|

| Note: This data excludes mortgages and government-held student loans |

It is useful to look at the breakdown of this growth. As discussed earlier (see post), we know that auto loans have been the darling of large US banks, particularly as mortgage refinancing slowed. The steady growth in auto finance at these institutions continues.

|

| “Other Consumer Loans” are mostly auto loans (nonrevolving credit) (note: this excludes mortgages and government-held student loans) |

But auto loans only partially explain the spike in consumer finance in recent months. The other component of consumer finance on banks’ balance sheets is revolving credit, which is mostly credit cards. In late March of this year, credit card debt balances at large US banks have bottomed – after years of declines. With credit card and auto finance both expanding now, the overall US consumer credit expansion has accelerated.

|

|

Note: this excludes home equity debt |