Those who see the current era as the New Normal also have one logical action: sell now at the top and wait for the smoke to clear in 2016.

In The Generational Short: Banks, Wall Street, Housing and Luxury Retail Are Doomed, I addressed how generational changes in values could affect the stock market. That values change over time is common sense, and so is the idea that values drive choices about purchases, debt and investments that ultimately influence stock valuations.

The implicit conclusion: the Baby Boomers won’t have anyone to sell their stocks, real estate and bonds to. Correspondent Eric A. demolished the fantasy that Gen X will have the income and assets to buy the Boomers’ stocks held in IRAs, local government and union pension funds and 401K accounts in Generation X: An Inconvenient Era (May 23, 2013).

The idea that Gen-Y will have the wealth (not to mention the desire) to buy the Boomers’ stock market portfolios at nosebleed valuations poses a peculiar conundrum:Â the only way Gen-Y will have the wealth to buy Baby Boomers’ assets is if the Boomers sell their assets and pass the wealth along to Gen-Y.

So if both Gen-X and Gen-Y are out as buyers, who’s left to buy the tens of trillions of dollars of Boomer assets at bubblicious prices? Given that other nations face the same demographic dilemma, the answer appears to be: no one.

Let’s move on to the question of whether the current valuations are an aberration or the New Normal. This matters, because if the period from 1994 to 2014 is a one-off aberration, that means stock valuations will eventually revert to historical levels far below current valuations.

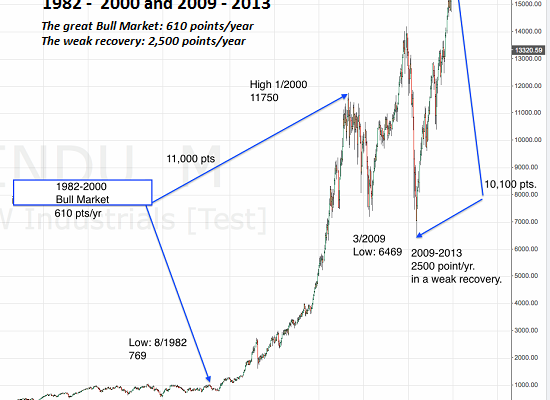

Here is a chart of the Dow Jones Industrial Average (DJIA) from 1955 to the present. Does the current era of bubbles and crashes look remotely normal, compared to the decades prior to 1994?

If this is the New Normal, then what that means is a bubble and crash every 7+ years is now the expected cycle. Here is an annual chart of the DJIA (courtesy of Harun I.; comments by CHS) that shows the megaphone pattern that’s been traced out in the New Normal era of huge bubbles and equally monumental crashes:

If this is indeed the New Normal, wouldn’t it make rather obvious sense to sell at the top (i.e. now) and wait for the New Normal crash and bottom around 2016?What evidence is there that this latest and greatest bubble is sustainable?

Next, let’s look at the fundamental relationship of stocks to the nation’s gross domestic product (GDP), a broad measure of the economy. Current sky-high stock valuations are not just aberrations in terms of previous stock prices–they’re aberrations in terms of stocks’ valuations compared to the nation’s entire economy.

Doesn’t it boil down to this? If we can’t come up with a viable cohort who can afford (and is willing to place that generational bet) to buy Baby Boomer assets at current bubble-level prices, then it follows that as the first Boomers start selling their assets, prices will fall as there is nobody left to buy them, at least at these valuations.

Those who see the current era as an aberration have one logical action: sell now and get out while the gettings good.

Those who see the current era as the New Normal also have one logical action: sell now at the top and wait for the smoke to clear in 2016.

Now that it’s evident that central banks have been buying stocks to prop up the bubble-level valuations (“Cluster Of Central Banks” Have Secretly Invested $29 Trillion In The Market — Zero Hedge), some may assume the central banks will buy another $29 trillion in stocks from the Boomers–or what the heck, make it $50 trillion or $100 trillion–there’s no limit, right?

How safe is that bet, i.e. that central banks will be able to buy most of global stock market without any consequences or blowback?

It might be safer to hope the Martian Central Bank prints a few trillion quatloos and shows up to save the bubble-era Boomer portfolios from self-destruction.