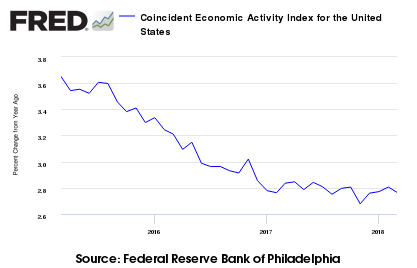

The above graph shows the rate of year-over-year growth for the US Coincident Index. A comparison of US Coincident Index, Aruoba-Diebold-Scotti business conditions index, Conference Board’s Coincident Index, ECRI’s USCI (U.S. Coincident Index), and Chicago Fed National Activity Index (CFNAI) coincident indicators follows.

Economic indicators that coincide with economic movements are coincident indicators. Coincident indicators by definition do not provide a forward economic view. However, trends are valid until they are no longer valid, making the trend lines on the coincident indicators a forward forecasting tool. Â Econintersect‘s analysis of the coincident indices is that:

- There is general agreement that the economy is expanding – all show the rate of growth is nearly flat (not increasing or decreasing to any significant degree) – and the growth is remaining fairly stable.

- You cannot take most of these coincident indices to the bank – as they are subject to backward revision.

- The economy is expanding at main street level – but the growth rate remains slow.

Excerpt from Philly Fed Report for the United States Coincident Index

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for May 2014. In the past month, the indexes increased in 38 states, decreased in five, and remained stable in seven, for a one-month diffusion index of 66. Over the past three months, the indexes increased in 45 states, decreased in three, and remained stable in two, for a three-month diffusion index of 84. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index rose 0.3 percent in May and 0.8 percent over the past three months.

[click graph below to enlarge]

/images/z philly coincident.PNG

| Â | 1 month change | 3 month change | 1 year change |

| Philly Fed Coincident | 0.3% | 0.8% | 3.1% |