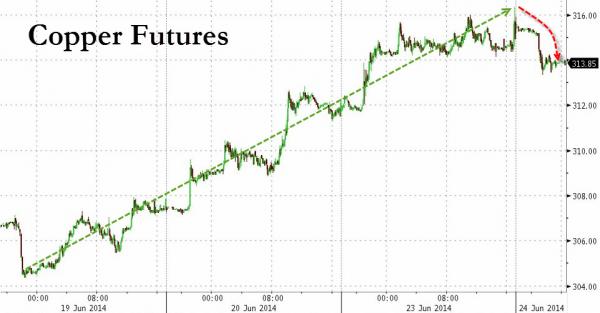

Quietly behind the scenes, amid all the chaos of the Qingdao probe’s contagion, copper has rallied modestly in the last seven days. That streak ended last night as the warehousing concerns we noted spreading to the entire sector, combined with a collapse in Chinese copper imports (down 17% in May), and yet another default (China Ting holdings said said two borrowers defaulted on entrusted loans). So it seems that not only are the commodities missing, but so is the money…as the slow motion train wreck gathers pace (no matter what PMIs or minis stimulus do to evade the tightening) as China’s money-market rates (at 5 month highs) suggest liquidity demand is very high (and desperate).

Â

Â

We saw this kind of squeeze higher in early May, which collapsed back to 2014 lows quickly as reality restruck and perhaps the plunge in copper imports was that wake-up call…

As Bloomberg notes,

China’s imports of refined copper fell 17 percent to 282,969 tons in May, customs data showed yesterday, marking the first monthly drop since February. Inbound shipments could fall further as theQingdao investigation may curb purchases from abroad by traders who use commodities as collateral to get loans, according to Ye Yonggang, an analyst with Jinrui Futures Co. in Shenzhen.

“China’s trade data showed a slowdown in the country’s demand for metals, clouding the demand outlook,†said Kazuhiko Saito, an analyst at Fujitomi Co., a commodities broker in Tokyo.

The country’s copper exports rose 31 percent to 28,149 tons, the highest since April 2013, customs data showed. Some copper may be moved from China to LME warehouses in South Korea, and possibly Singapore and Malaysia, according to Jeremy Goldwyn, head of business development in Asia at Sucden Financial Ltd.

China’s imports of zinc and lead also declined in May from a month earlier, customs data showed.