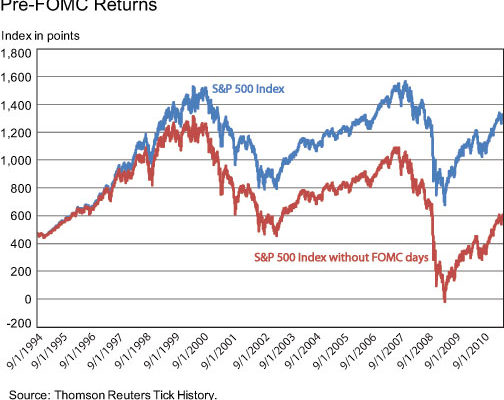

When it comes to strange market timing patterns, for the longest time we thought that it would be impossible to top the following chart by the New York Fed from July 2012, one we dubbed the “Chart of the Year”, showing that the cumulative “bullish” return of the S&P 500 on just the day preceding FOMC meetings resulted in some 800 points in upside in the broader market.

Â

The NY Fed described this truly arcane phenomenon as follows:

We show that since 1994, more than 80 percent of the equity premium on U.S. stocks has been earned over the twenty-four hours preceding scheduled Federal Open Market Committee (FOMC) announcements (which occur only eight times a year)—a phenomenon we call the pre-FOMC announcement “drift.â€

Surely, this is as bizarre as any “market timing” chart can get? Not so fast.

According to a paper by economists at UC Northwestern University and UC Berkeley, Anna Cieslak and Adair Morse and Annette Vissing-Jørgensen, another, even more surprising trading pattern using FOMC announcement has emerged. Specifically, anyone who engaged in the simple “even” strategy of buying the stocks of the S&P 500 on the day before a Fed policy announcement, selling them a week later, then buying them again the following week and sticking with the pattern until the subsequent Fed meeting generated a whopping 650% return since 1994, far outperforming the inverse “odd” strategy which shocking had a negative return over the past two decades years, and jsut as surprisingly, outperforming the market’s own 505% return during this period.

Behold what may be the most bizarre pattern chart yet:

Â

As the WSJ adds, “the pattern of stocks performing better in even weeks of the Fed cycle—the week of the policy-setting meeting, two weeks after it, and so on—is persistent. Given financial markets’ complexity, though, it is possible to find many interesting, significant-seeming patterns that are really just matters of chance.”