It’s common sense – everyone knows that interest rates are going to rise (how can they fall any lower?) Inflation will come back (because the Fed said so), economic growth will flourish (because the Fed said so), and longer-term bond yields will surge in a bond-bull-destroying renaissance proving stock market speculators right all along.

Except that isn’t what history shows us.

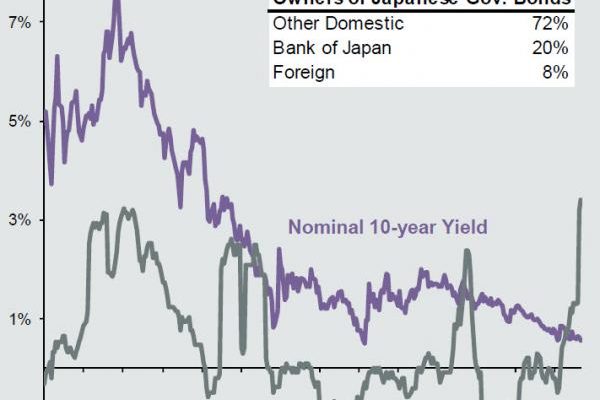

When a central bank dominates the domestic bond market, all bets are off (whether economically rational or not). When a sovereign simply cannot afford higher interest rates, all bets are off (no matter what your economic textbook says).

Â

Source: JPMorgan

Â

Simply put – this is not your father’s bond market anymore.