With Austrian bank contagion impacting European stocks on Friday, we thought it worth a look at the ‘recovering-out-of-the-crisis-all-is-well-and-stress-tests-will-prove-it’ European banks. It appears, having bid with both hands and feet for Europe’s peripheral debt – thus solidifying the very sovereign-financial-system linkages that were the cause of the European crisis contagion – Europe’s banks had the jam stolen from their donuts when Mario Draghi did not unveil a massive bond-buying scheme (by which they could offload their modestly haircut collateral at 100c on the euro, raise cash, take profits, and all live happily ever after). A TLTRO is no use to the banks who now know even the first sign of one dumping his domestic bonds will cause this illiquid monstrosity to collapse under its own weight. It is clear – as the following chart shows – that investors are quickly coming to that realization and exiting European bonds in a hurry.

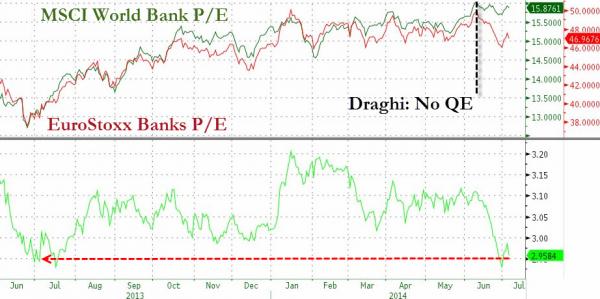

Since Draghi failed to unveil QE, European banks have collapsed to one-year lows relative to world banks…

Â

Â

Of course, some knife-catching Bill-Miller-ite will come to the rescue, buying-the-dip – but as BNP’s Ian Richards notes,Â

“The prospect of supporting material credit growth and better earnings revisions in the banking sector is further down the line than the market had hoped.â€

Source: Bloomberg