For the average person trying to decide how to feel about the economy, the single biggest data point is the stock market. When share prices are rising, the implicit message is that finance professionals — who, after all, dedicate their lives to understanding such things and should therefore know what’s happening — have decided that life is good and getting better.

So the rest of us relax and go shopping. Known as the “wealth effect,†this tendency of asset prices to affect consumer behavior is now a key policy goal of the US and pretty much every other major government.

But what if it’s all a gigantic, multi-trillion dollar con? That’s the conclusion a growing number of analysts are reaching as they dig into the reality behind the recent record highs in US equity prices.

The first part of the story goes like this: The US has lowered interest rates to the point where it is actually more profitable for many companies to borrow money and use the proceeds to buy back their own shares, thus eliminating the need to pay dividends on those shares. Gordon T. Long of Macro Analytics recently ran the numbers:

THE BUYBACK TAX RUSE: Its a Free Tax Ride for Corporations

What do corporate CEOs and Boards know which everyone is missing and that is driving them to executing corporate buybacks approximating $2 Trillion over 24 months? The answer is a free tax ride thanks to the Macroprudential Strategy of the Fed’s ongoing game of Financial Repression. A game which may be quickly getting out of control!

UNPRECEDENTED BUYBACKS LEVELS

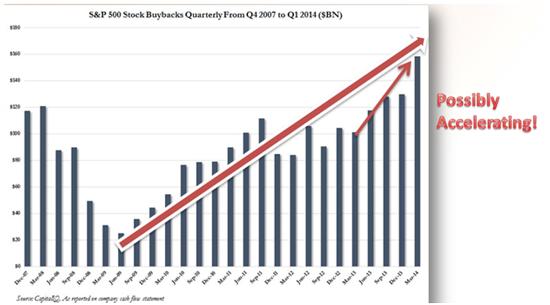

In case you are in the 1% who have been too busy counting your startling increase in net worth, let me first highlight the velocity with which corporate buybacks have accelerated to.

90% of all S&P 500 profits are presently being spent on corporate Buybacks and Dividends. This is historically unheard of. We are approaching nearly $2 Trillion in buybacks by the S&P 500 members within a forecasted 2 year period. So why is this distortion happening?

A FREE TAX RIDE

We presently have one of the biggest tax ruses in history going on as the Fed and US Treasury desperately try and increase the wealth effect to elevate asset prices and finance government debt. To make low bond yield seem relatively attractive (at present historic lows), the Fed needs to get stock yields down via elevating stock prices. Corporations have been willing accomplices in this charade.GENERIC TAX EXAMPLE

Assumptions:

 Dividend payout rate approximates the S&P 500 average of 2.25% per annum.

 Borrowing costs approximate 3.5% per annum

 Corporate nominal US tax rate 35%

 Assume stock trades at $100/share with 100 shares outstanding,

 Market Capitalization of $10,000 (100 X 100)A 2.25% Dividend rate means a $2.25 Dividend payout per year.

If we were to borrow $225 to buyback 2 1/4 shares it would cost $7.89 ($225 @ 3.5%)

The tax deductibility of $7.89 at a nominal tax rate of 35% would be $2.76

Therefore our model corporation would save $0.51 ($2.76 – $2.25)) by borrowing to buy back their shares.