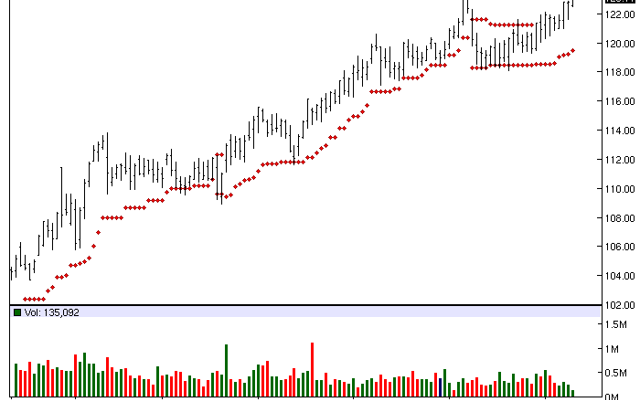

The Chart of the Day belongs to Federal Realty Investment Trust (FRT). I found the stock by sorting the All Time High list for new high frequency in the last month, then used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 6/27 the stock gained 1.41%.

FRT is an owner, operator & redeveloper of retail properties. The Trust’s strategy is to acquire older, well-located properties in prime, densely populated & affluent areas & to enhance their operating performance through a program of renovation, expansion, reconfiguration & retenanting. The Trust’s traditional focus has been on community & neighborhood shopping centers that are anchored by supermarkets, drug stores or high volume, value oriented retailers that provide consumer necessities.

(click to enlarge) Â

Â

The status of Barchart’s Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read.

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 3.09% in the last month

- Relative Strength Index 64.55%

- Barchart computes a technical support leve at 121.21

- Recently traded at 123.18 with a 50 day moving average of 119.95

Fundamental factors:

- Market Cap $8.23 billion

- P/E 26.18

- Dividend yield 2.54%

- Revenue expected to grow 5.20% this year and another 5.60% next year

- Earnings estimated to increase 15.30% this year, an additional 9.70 next year and continue to increase about 1.00% annually for the next 5 years

- Wall Street analysts issued 1 strong buy, 2 buy, 4 holds and a single sell recommendation on the stock

Treat this as a total return stock and exit if the total return drops to a negative 10%.