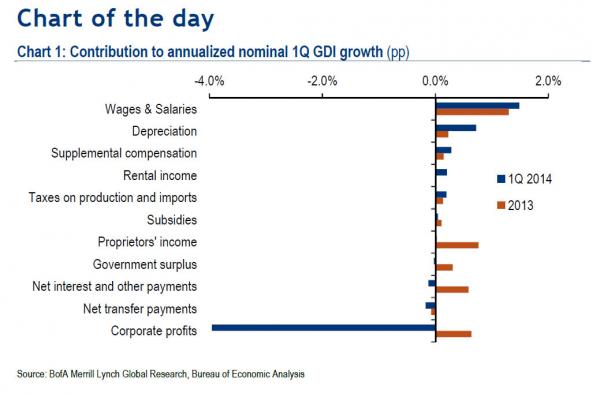

Yup: strong corporate profits. Strong like bull(shit).

Â

from BofA:

Contribution to annualized nominal 1Q GDI growth: Real Gross Domestic Income plunged 2.6% in 1Q, nearly matching the decline in GDP. Looking at the components (only available in nominal terms), the biggest driver of the decline was a collapse in corporate profits, which offset a trend-like increase in wages and salaries. The decline in corporate profits is indicative of weaker aggregate demand and a drop in productivity.

All, conveniently predicted right here. But… but… 5% non-GAAP EPS growth!