From today’s FT:

Â

ECB under pressure to tackle ‘crazy’ euro

Pressure is mounting on the European Central Bank to take action against a persistently strong euro with a leading industrialist calling on Frankfurt to tackle the “crazy†strength of the currency.

…

Fabrice Brégier, chief executive of Airbus’s passenger jet business, said the ECB should intervene to push the value of the euro against the dollar down by 10 per cent from an “excessive†$1.35 to between $1.20 and $1.25.

…

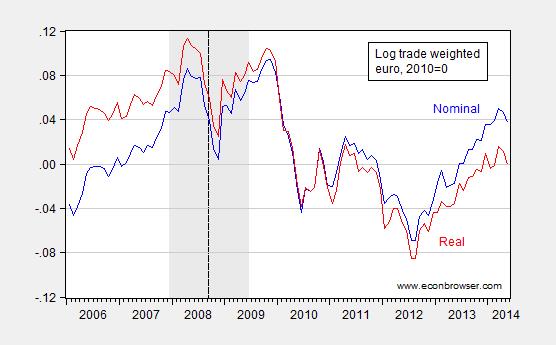

Following the euro over time, it’s clear that the euro is fairly strong, although not matching the levels in period just around the financial crisis. Remember, however, the dollar was particularly weak — and hence the euro particularly strong — just before the onset of the recession.

Figure 1:Â Log trade weighted value of the euro (broad), nominal (blue) and real (red), 2010=0. NBER defined US recession dates shaded gray. Dashed line at Lehman bankruptcy. Source: BIS.

Still, with euro area growth just barely creeping into the positive area, and with inflation far below target range, one could easily see how a weaker euro could help on both counts.

In terms of competitiveness, one would want to look to the unit labor cost deflated measures, rather than the CPI-deflated measure. Here, the same pattern emerges.

Figure 2:Â Log CPI-deflated trade weighted value of the euro (blue), and relative unit labor cost deflated (red), 2010=0. NBER defined US recession dates shaded gray. Dashed line at Lehman bankruptcy. Source: IMFÂ IFS.

In the past, I (along with Jeff Frieden) have urged an increase in inflation. We didn’t post a mechanism for achieving that higher inflation, although the usual unconventional monetary policy measures — including credit easing– would have been in contention. However, increasing the ECB’s balance sheet faces some difficulties, ranging from legal to operational.