Having admitted that the banking system problems in Portugal could be systemic, the President has a bigger problem now as the 3rd (and final) Holdco of the Banco Espirito Santo capital structure fiasco just filed for bankruptcy:

- *ESPIRITO SANTO FINANCIAL GROUP SEEKS PROTECTION FROM CREDITORS

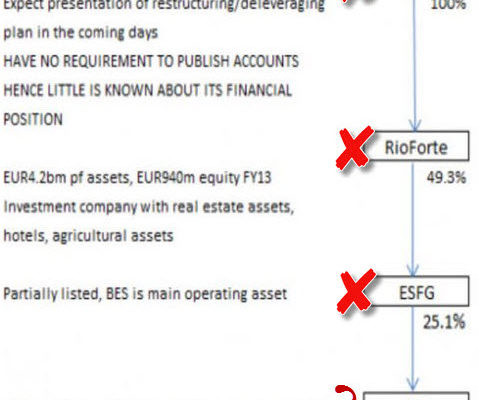

First it was ESI (storm in a teacup), then RioForte (“contained”), and now ESFG (“systemic”), and given the CEO’s recent “detention” for money-laundering, we wonder how long before Banco Espirito Santo is forced to liquidate?

As Bloomberg reports,

Espirito Santo Financial Group SA says it requested to be placed in the regime of “controlled management†under Luxembourg law, according to a regulatory filing.

Espirito Santo Financial Group says it concluded that “it is unable to meet its obligations under its commercial paper program and obligations associated with the company’s standalone debt obligations.â€

One by one they fell…

It’s Systemic!

President Anibal Cavaco Silva is the first high-profile politician to warn of a possible economic impact from the Espirito Santo crisis, after the family asked for creditor protection for one of its key holding companies on Friday.

…

“We cannot ignore that there will be some impact on the real economy.”

Which does not leave much room for Portugal’s growth….

And now the CEO is detained on money-laundering:

*PROSECUTOR COMMENTS AFTER SALGADO APPEARS BEFORE JUDGE

*PORTUGUESE PROSECUTOR SAYS SALGADO MUST REMAIN IN COUNTRY