My wife and I sold two condominiums near the tail end of 2005. We could not justify owning residences that were 40% more expensive to own than to rent. Simply put, it was time to cash in.

Due largely to my comfort with the liquidity of market-based securities, I did not wade back into the real estate investment waters until 2012. I purchased a mixed-use property in a short sale. And today, I operate Pacific Park Financial, Inc. – a Registered Investment Adviser with the SEC – from the quasi-residential location.

Here in 2014, the inevitable nature of change inspired my wife and I to list our primary home. As a home seller this time around, however, the decision to sell has had little to do with a looming real estate bubble. My 18-year-old daughter is heading off to college. Our half-Papillon mix passed away. And we do not feel the need for the same amount of living space.

Although I have highlighted the dramatic decline in home sales in column after column over the last year, I have never expressed a feeling that property values had ascended to exorbitant heights. After all, price-to-rent ratios are relatively reasonable. The 30-year fixed has actually pulled back from 4.5% to 4.2% since the start of 2014. Meanwhile, the combination of demand for fixed income coupled with Federal Reserve guidance as well as geopolitical uncertainty should keep rates attractive for homebuyers.

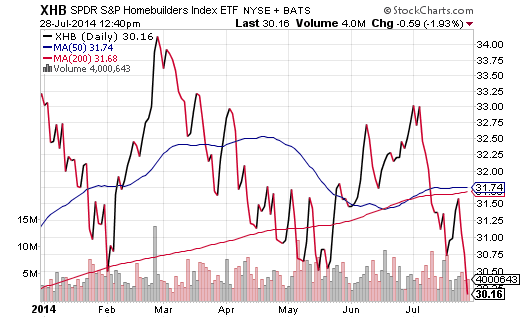

So where are those upwardly mobile homebuyers in an environment where unemployment continues to decline? Understanding that all real estate is local, why has my home experienced a mere handful of visitors after 30 days on the market? Moreover, if the housing recovery is genuinely on solid ground, why on earth are home builders in the SPDR S&P Homebuilder ETF (XHB) down 9.3% year-to-date?

The answer is threefold. Families have less purchasing power than they did in 2009, financial institutions are making mortgages difficult to obtain and the year-over-year increase in mortgage rates is making it challenging for many would-be buyers to qualify.