Three years ago I called attention to the NYU Stern Volatility Laboratory. Since then it’s grown into an even more amazing resource, giving anyone access to constantly updated information about financial conditions in dozens of countries around the globe. Of particular interest are recent changes in their measure of the systemic risk posed by financial institutions.

The basic idea behind the systemic risk posed by financial institutions is to use real-time summaries of the valuations and correlations across different equities to analyze how much of a drop would be expected in the stock valuation of a given financial institution if the country were to face another financial crisis, defined as a 40% decline in the broad market stock index over a space of 6 months. Technical details of how that calculation is done are described in a paper by Acharya, Engle, and Richardson (2012). This loss in equity value is then compared with the institution’s current assets and liabilities to calculate how much additional capital might be needed in order to keep the institution solvent in the event of a financial crisis. The sum of this cost across all financial institutions then gives a measure of a country’s overall systemic risk at any point in time.

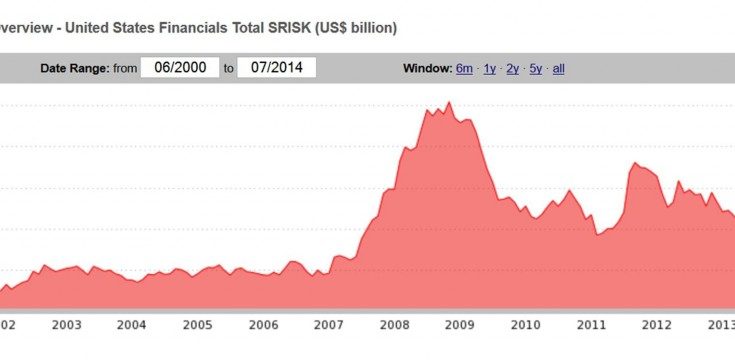

For example, here’s what their measure looks like for the United States. It peaked at over a trillion dollars in the fall of 2008, but has improved significantly since, and is now down to about $300 billion.

Source:Â systemic risk posed by financial institutions.

By contrast, sovereign debt concerns pushed the index for Europe in 2011-12 back up near values from the financial crisis of 2008. The measure of systemic risk for Europe has since abated, though it remains quite elevated at about $1.3 trillion.

Source:Â systemic risk posed by financial institutions.

And reason for concern about Japan has actually increased substantially in the years following the 2008 financial crisis. Notwithstanding, the policies adopted early in 2013 popularly described as “Abenomomics†seem to have helped.