Janet Yellen said today that there is still considerable slack in the economy in terms of labor and capital. So there is less pressure to tighten monetary policy earlier.

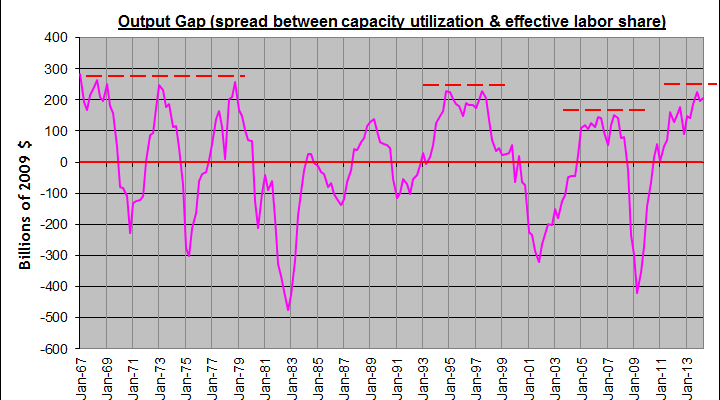

Just for the record, from my own research there is little spare capacity left… Here is my graph… Warning! The potential GDP used in the graph below is not the CBO Potential. It is my own determination of potential GDP based on Effective Demand.

Â

I measure the output gap as a % difference between capacity utilization and effective labor share.

For most of the past 40 some years, my measurement was close to the CBO measurement of the output gap, as seen in the following graph. (Blue line is real GDP – CBO potential).

Â

Â

Janet Yellen must officially follow the blue line. She must see a large output gap. Yet I am seeing the output gap already filled in and real GDP nearing its natural limit. Inflation is ticking up. Unemployment is dropping faster. Stock market is hitting new highs. Profit rates have stopped rising.

Â

Some speculation… What if the CBO projection of potential GDP is much too large? Well the economy will heat up much faster than the Fed expects, as seems to be happening now. Most likely they will be caught behind the curve. In which case, nominal interest rates would either have to rise sooner than expected, or be stuck at the zero lower bound as the instability of the economy warns against a nominal rate rise. In other words, the economy is more sensitive to a nominal rate rise now than it was say 2 years ago. Conceivably, the Fed may not want to tighten monetary policy, if the markets start decaying by the 2nd quarter of 2015. We could possibly head toward the next recession with the zero lower bound.

There looks to be a drama unfolding in monetary policy.