While we are used to the daily flashing red headline from GM on recalls, today’s was a lot more concerning:

- *GM RECEIVED SUBPOENA BY U.S. DOJ

- *GM SUBPOENA RELATED TO SUBPRIME AUTOMOBILE LOAN CONTRACTS

- *GM FINL: SUBPOENA ALSO FOR WARRANTIES ON UNDERWRITING CRITERIA

We have warned of the surge in subprime auto-loan lending (and lowering standards and rising delinquencies)Â but this move by the DoJ should be very concerning. Once investors began digging into the details of subprime mortgage deals in 2007, the drastic credit risks reality was exposed very quickly…Â we fear the same in auto loans.

We have warned of the surge in subprime auto-loan lending (and lowering standards and rising delinquencies)Â

Auto-loans are surging… Subprime auto-loans were up 10-fold in 2013…

As OCC reports,

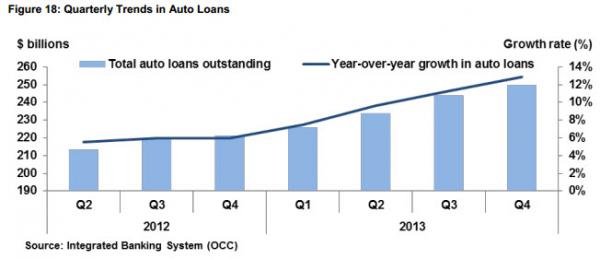

Auto lending remained a highly competitive product segment, as strong growth continued through the end of 2013.

Â

Banks reported year-over-year growth of 11.3 percent in the third quarter of 2013 and 12.9 percent in the fourth quarter of 2013 (see figure 18). Banks continue to hold a sizable market share of outstanding loans of $250 billion, or 31 percent of the total auto lending market.

But risks are rising… Signs of Risk in Auto Lending Beginning to EmergeÂ

Across the industry, auto lenders are pursuing growth by lengthening terms, increasing advance rates, and originating loans to borrowers with lower credit scores. Loan marketing has become increasingly monthly-payment driven, with loan terms and LTV advance rates easing to make financing more broadly available. The results have yet to show large-scale deterioration at the portfolio level, but signs of increasing risk are evident. Average LTV rates for both new and used vehicles are above 100 percent for all major lender categories, reflecting rising car prices and a greater bundling of add-on products such as extended warranties, credit life insurance, and aftermarket accessories into the financing (see figure 26).

As we have numerous times…