If you read most media reports on People’s Bank of China’s latest monetary policy direction, it would seem that the central bank has only been focused on some targeted stimulus initiatives.

Want China Times: – China’s central bank said on Wednesday that it will continue to implement a targeted approach in monetary policy in the second half of 2014 and shore up weak links in the economy.Â

More financial support will be provided to rural areas and small businesses to reduce their financing costs, according to a statement on the website of the People’s Bank of China.

But are the central bank’s initiatives truly as limited in scope as these stories would make us believe? Recently the PBoC has been experimenting with some unconventional policy tools that make it rather difficult to assess how loose the overall policy has been.

Xinhua: – The People’s Bank of China has developed two or three monetary tools to guide short- and medium-term interest rates via an effective monetary policy transmission mechanism, said PBOC Governor Zhou Xiaochuan on the sidelines of the China-US Strategic and Economic Dialogue in Beijing on July 10.

Pledged supplementary lending [PSL], a lending instrument backed by collateral, is a new monetary tool to guide medium-term interest rates.

…Â

“The PBOC is becoming increasingly reliant on innovative monetary tools. It’s trying not to adjust interest rates or the reserve requirement ratio, because these aren’t good measures to control the direction of capital flows. So the central bank is putting greater emphasis on targeted adjustment by using tools like re-lending and PSL,” Zhu said.

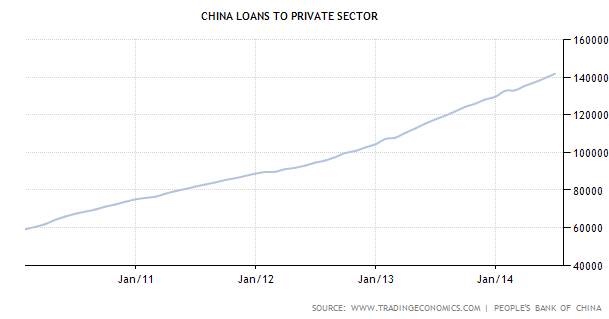

And there are other indicators of China’s monetary policy, such as loans to the private sector (below) and the exchange rate policy.

Â

Bloomberg has developed an index that combines some of these measures in order to assess just how loose the overall monetary policy has been. The results seem to indicate that the level of stimulus has actually been significantly higher than one would surmise from the media reports.