Under normal economic conditions, the Fed funds rate would be higher. Yet, the Fed funds rate has been effectively at the zero lower bound for years. Why? Well, the answer is simple… The Fed has lost track of how to measure potential GDP and true slack. The problem is that the Fed has no awareness of an effective demand limit upon potential GDP.

The Effective Demand model for the Fed Funds Rate

To show that the Fed rate would be higher, I use the rule from my effective demand research for monetary policy. Let’s remember that a rule should be balanced by discretionary policy within limits. Ok, I give the effective demand equation to determine the Fed rate.

Effective Demand Fed Rate Rule = z*(TFUR2 + LSA2) – (1 – z)*(TFUR + LSA) + inflation target + 1.5*(current inflation – inflation target)

z = (2*LSA + NR)/(2*(LSA2Â + LSA))

TFUR = Total Factor Utilization Rate, (capacity utilization * (1 – unemployment rate))

LSAÂ = Labor Share Anchor which stays fairly stable throughout a business cycle.

NRÂ = Natural real rate of interest (assumed to be 3% until the 2001 recession, 2.5% up to the end of 2007, then 1.8% thereafter.)

Inflation target = (assumed to be 3.0% up to 1980, and 2.0% thereafter.)

1.5 coefficient = To give the Fed rate leverage when inflation gets off target. Fed rate would change 1.5x more than inflation is off target.

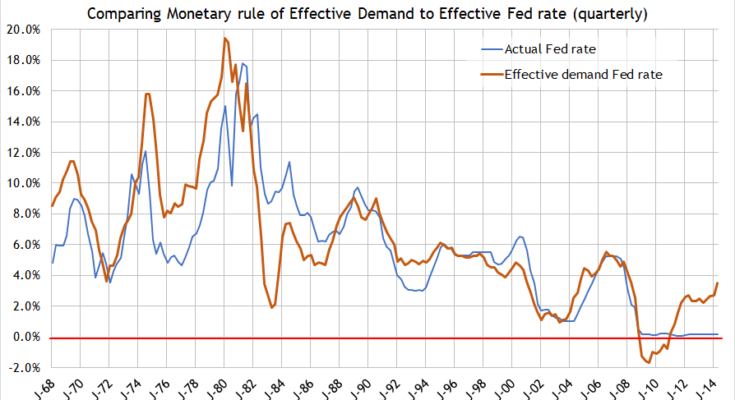

What does this equation look like over time? Here is a graph comparing the Effective Demand Rule to the Effective Fed funds rate since 1968…

When the actual Fed rate (blue) is above the ED rule (orange), I would say that monetary policy is too tight. Likewise when the actual Fed rate is below the ED rule, I would say that monetary policy is too loose.

In general, monetary policy was too loose through the 1970′s… too tight through the 1980′s… too loose in the early 1990′s… too tight around the turn of the century… a bit too loose after the 2001 recession… and pretty spot on right before the crisis. Currently, the Fed rate is very very loose.