The UK’s latest inflation report has shifted the expectations of the first rate hike by the Bank of England.

The Guardian: – August inflation report laid bare the dilemma over the timing of the first rise faced by the Bank’s policymakers, who are struggling to reconcile rapidly falling unemployment and record employment with very weak wage growth [see chart].

On the one hand, members of the Bank’s rate-setting monetary policy committee (MPC) revised down their estimate of spare capacity in the economy to 1% of GDP from a May forecast of 1-1.5%, as employment growth rockets.

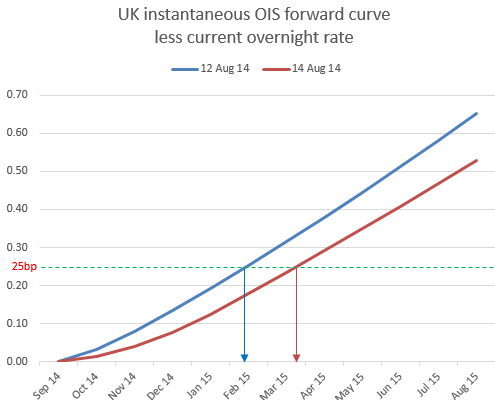

The Overnight Index Swap (OIS) curve shift shows the impact of the inflation report on the timing of the first 25bp hike.

Â

When combined with the current geopolitical uncertainty, the UK inflation report should keep the BOE on hold well into 2015. The fear of rate normalization has been pervasive across major central banks and dovish attitudes are likely to prevail at Jackson Hole (see quote). Once again, the longer the central banks delay the start of this process, the more difficult and disruptive the exit will ultimately be.