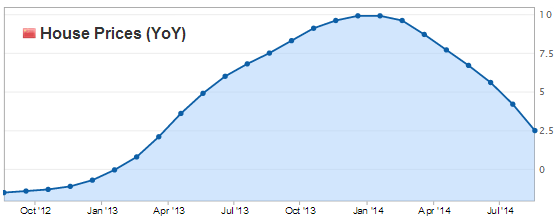

China’s official housing index now shows home price appreciation slowing faster than some had anticipated.

Source: Investing.com

Other indicators are also pointing to weakness in China’s housing markets. For example the number of cities with falling prices has spiked sharply.

Source: Scotiabank

Furthermore, the steel rebar futures in Shanghai – an important real-time indicator of construction demand – remain under pressure.

Jan steel rebar futures in Shanghai (barchart.com)

Related to this trend, China’s commercial floor space and the number of commercial buildings sold has declined materially (based on official reports).

Source:Â National Bureau of Statistics

There is no question that Beijing has the wherewithal and the will to support the housing market should things unravel faster than the government likes. Nevertheless, given how pervasive property markets are in the nation’s overall economy, concerns among global investors are rising with respect to China’s housing slowdown.

Scotiabank: – On the theory that where there’s smoke there’s fire (and it’s not just because I’m BBQing), weak company financing and concerns surrounding potential defaults in the shadow banking sector coupled with — and likely driven by — further evidence of falling property prices will only amplify the concerns.

Â