We are experiencing a (hyper)inflationary depression. As a consequence of Quantitative Easing (exponential growing money supply) the price of Low Order Consumer Goods (LOCG) stays high and keeps rising and the price of High Order Capital Goods (HOCG) comes down. [with the exception of seasonal and other short term fluctuations].

Real Estate is a HOCG and does not protect savings.  During the Weimar Hyperinflation Rentals were more or less nominal and in the period of hyperinflation , housing was obtained practically free of charge . In reality the property of the landlords was confiscated. Imports but also exports were controlled. Argentina taxes the export of food but Germany simply banned it. During those years interest rates were never raised sufficiently to prevent a negative return. Buyers were eager to purchase anything which would maintain value. Hence the more rapid the rise in price the greater the demand.  People purchased not what they needed but whatever they could get.Â

All of the technological improvements of the last decades originated in capitalistic countries. The people of the USA are now more prosperous than the inhabitants of all other countries because their government embarked LATER than the governments in other parts of the world upon the policy of obstructing business. Once popular government (democracy) popular controls the production and distribution it’s GAME OVER. Mainly because of misallocation of funds, taxation and regulation it chases away (or consumes) Capital and Entrepreneurs.

They are fabricating the DREAM BUBBLE…with the help of Derivatives, Central Banks and Propaganda.

| The fairy tale is almost perfect. |

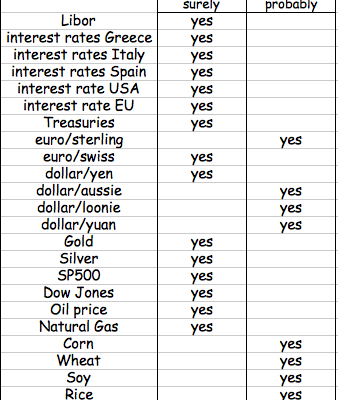

Financial markets are rigged..thanks to Derivatives which are a mighty weapon.

- with the help of swaps currencies are maneuvered within a certain trading channel (up and down)

- the price of food commodities (wheat, corn, soy, sugar) is locked

- gold, silver, palladium, platinum, copper, …the price of most metals is rigged

- energy: crude oil, natural gas and uranium…even with a war raging in the Middle-East, the price comes down and is staying low.

- interest rates are miraculously staying low. Swaps are the magic.

- price of short and long term treasuries is miraculously staying high

- stock markets are going up because either the co’s are buying in their own stocks ore the FED or ECB are buying.