Several months before Shinzo Abe took office as the Prime Minister of Japan, the pre-ordained leader had expressed a fierce determination to jump start Japan’s economy through unconventional monetary policy measures. Like the U.S. Federal Reserve, the Bank of Japan (BOJ) would electronically create yen to acquire less liquid assets, such as government bonds.

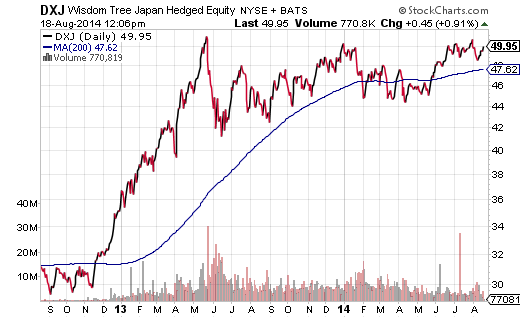

For a six-month stretch (11/16/2012-5/15/2013), Japanese stocks rocketed alongside speculative support for the yen creation trade. WisdomTree Hedged Japan (DXJ) and iShares MSCI Japan (EWJ) logged 67.5% and 41.2% respectively. In spite of the remarkable run-up, however, Japanese equities flat-lined over the 15 months that followed.

Naturally, if anyone were able promise you a 21-month or two-year return in the neighborhood of 65%, you would not care if it happened in a flash or in a gentle uptrend. Nevertheless, it is difficult to look at 18 months of futility as a sign that Japan’s quantitative easing efforts are still creating a “wealth effect†that inspires longer-term confidence in “Abenomics.â€

Consider the yen via Currency Shares Japanese Yen Trust (FXY) in 2014. With all of the liquidity that the BOJ had supposedly pumped into the country’s economy – with the U.S. Federal Reserve scaling back on its asset purchases in a modest effort of de facto tightening – with one of the worst contractions in Japan’s GDP in many years – wouldn’t one expect FXY to fall further in value? Instead, it is holding onto modest gains achieved early in the year.

Granted, investments from the yen to the dollar to German bunds to gold to U.S. Treasuries have all benefited from ‘risk-off’ demand year-to-date. Blame it on a five-and-a-half-year equity bull market or even profit taking on perceived overvaluation. Heck, express concern about the sheer number of military engagements in geopolitical hot spots around the world. Yet it is also possible that the yen’s 25% slide has run its course until the BOJ decides to create more electronic money. And if yen short sellers or Japanese equity owners had any sway over bureaucratic decision-making, more yen would be swirling about and benefiting Japanese exporters today.