Janet Yellen speaks at 10 am, EST and she’s scheduled to discuss her “Labor Dashboard” and, from that, the pontiffs will then attempt to read the tea leaves of Future Fed action. Â She’ll likely note that the Labor Market is generally improving but that there is no immediate reason to raise rates. Â The definition of immediate will be much debated. Â

If that does not confuse us enough, we will hear from 7 of the Fed Dwarves as well including Williams, Lockhart, Plosser and Bullard.  Draghi takes the stage at 2pm, EST.  In case Yellen’s empty promises don’t do the trick, Draghi is sure to have even emptier ones – whatever it takes to end the week on a positive note! Â

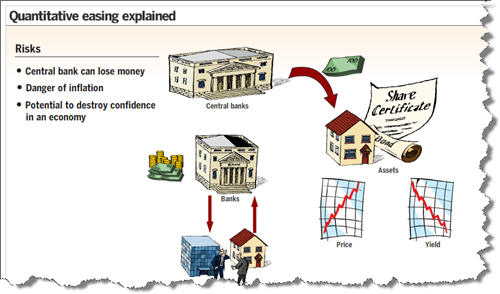

Still, we’re playing the day bearish (we added bear plays in yesterday’s Live Member Chat and we’re short /YM below 17,000 along with other Futures) as it’s hard to imagine what Yellen and company can possibly say that they haven’t already said.  Unlimited amounts of FREE MONEY forever is already priced into market expectations – anything less will be a severe disappointment.  Any firm mention of ending QE in the next 12 months can send the markets down sharply.  As “clarified” by Goldman Sachs:

With opinions mixed as to whether or not Jackson Hole will be the forum for Yellen to say something new, many are trying to figure out if it is a buy the rumor and then buy more after the fact event, a buy the rumor sell the fact event, or a do nothing with the rumors and then buy the fact if the USD is actually rallying after the fact event.

According to Zero Hedge, only “Full Doveish” statements are likely to lift the markets at this point. Â Those would be for Yellen to:

1) Argue that the natural rate is less than 5 ¼ - 5 ½ %

2) Advocate for a temporary overshoot of the inflation target

3) Emphasize the uncertainty around NAIRU estimates that tightening can wait till there is real evidence of accelerating inflation.

4) Introduce a soft wage target of about 3.5%, consistent with aspirational 1.5% productivity growth and 2% unit labor cost growth