Top market movers and lessons for the prior and coming week and beyond – special focus on existential decisions EU must soon face

Summary

–Technical Outlook: European indexes diverge from those of US, Asia, reflecting Europe’s underperformance

–Fundamental Outlook: They key drivers continue to dominate, Ukraine and weekly data playing secondary role as markets rally despite Ukraine and mixed data

–Longer Term Fundamental Threats: EU existential threats demand existential decisions

The following is a partial summary of the conclusions from the fxempire.com weekly analysts’ meeting in which we cover outlooks for the major pairs for the coming week and beyond.

TECHNICAL PICTURE

We look at the technical picture first for a number of reasons, including:

Chart Don’t Lie: Dramatic headlines and dominant news themes don’t necessarily move markets. Price action is critical for understanding what events and developments are and are not actually driving markets. There’s nothing like flat or trendless price action to tell you to discount seemingly dramatic headlines – or to get you thinking about why a given risk is not being priced in

Charts Also Move Markets: Support, resistance, and momentum indicators also move markets, especially in the absence of surprises from top tier news and economic reports. For example, the stronger a given support or resistance level, the more likely a trend is to pause at that point. Similarly, a confirmed break above key resistance makes traders much more receptive to positive news that provides an excuse to trade in that direction.

Overall Risk Appetite Medium Term Per Weekly Charts Of Leading Global Stock Indexes

Â

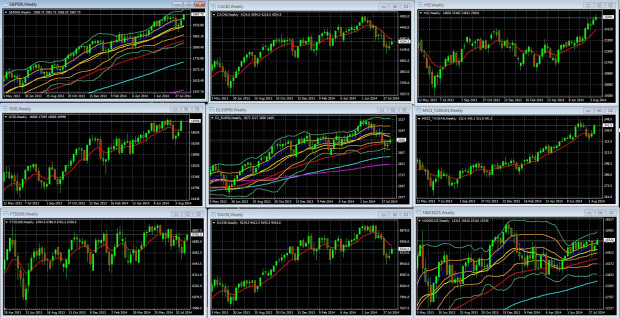

Weekly Charts Of Large Cap Global Indexes May 5 2013 To Present, With 10 Week/200 Day EMA In Red: LEFT COLUMN TOP TO BOTTOM: S&P 500, DJ 30, FTSE 100, MIDDLE: CAC 40, DJ EUR 50, DAX 30, RIGHT: HANG SENG, MSCI TAIWAN, NIKKEI 225

Key For S&P 500, DJ EUR 50, Nikkei 225 Weekly Chart: 10 Week EMA Dark Blue, 20 WEEK EMA Yellow, 50 WEEK EMA Red, 100 WEEK EMA Light Blue, 200 WEEK EMA Violet, DOUBLE BOLLINGER BANDS: Normal 2 Standard Deviations Green, 1 Standard Deviation Orange.

Source: MetaQuotes Software Corp, www.fxempire.com, www.thesensibleguidetoforex.com

02 Aug. 24 09.59

Key Points

Regional Momentum Divergence Continues

Overall, US and Asian stocks not only remain in their medium term and long term uptrends, last week they also regained their upward momentum as they closed the week within their DOUBLE BOLLINGER BANDS, thus putting the odds in favor of further net gains in the weeks ahead. Note that these trends remain positive (with indexes at nor near all-time highs in the US) even though US data reflects only modest recovery in the US and both China and Japan have seen slowing growth.