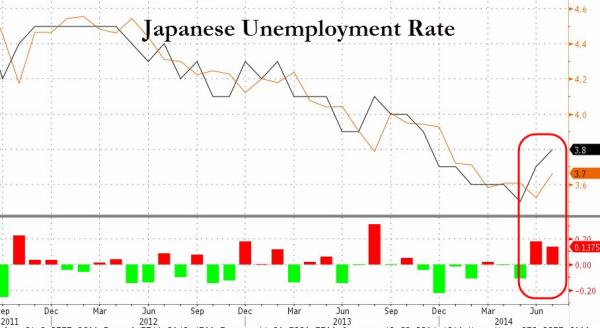

Just when you thought it couldn’t get any worse… In a veritable deluge of data from Japan tonight, there is – simply put – no silver lining. First, Japan’s jobless rate unexpectedly jumped to 3.8% – its highest since Nov 2013 (despite the highest job-to-applicant ratio in 22 years). Then, household spending re-collapsed 5.9% for the 4th month in a row (showingh no sign of post-tax-hike-recovery). Industrial Production was up next and dramatically missed expectations with a mere 0.2% rebound after last month’s plunge (-0.9% YoY – worst in 13 months), quickly followed by a 0.5% drop in Japanes retail trade MoM (missing hope for a 0.3% gain). That’s good news, right? Means moar QQE, right? Wrong! Japanese CPI came hot at 3.4% YoY with energy costs and electronic goods ‘hyperinflating’ at 8.8% and 9.1% respectively. As Goldman’s chief Japan economist warns, “the BOJ doesn’t have another bazooka,” adding that “The window for reform may already have been half closed.” We’re gonna need another arrow, Abe!

Â

Japanese unemployment jumps to highest since Nov 2013…

Â

But the job-to-applicant ratio is at its highest since 1992 (no incentive to work?)

Â

Blowing the idea that “slack” is creating deflation out of the water.

Household spending then collapsed 5.9% YoY… 4th month in a row…

As Bloomberg notes, Inflation-adjusted household income fell 6.2% in July y/y, extending its slide to a 10th month in a row, according to data released today by Japan’s statistics bureau.  That is the longest period of declines since at least 2004

Retail Sales dropped and missed again…

Â

- Credit creation slowed as Loans rose only 1.95% YoY – slowest since March

But don’t expect Moar QQE… as inflation is on fire…

- MNI: JAPAN JULY CPI ELECTRONICS GOODS +9.1% Y/Y VS JUNE +8.0%

- MNI: JAPAN JULY CPI ENERGY COSTS +8.8% Y/Y VS JUNE +9.6%

- MNI: JAPAN JULY CPI TVS +11.8% Y/Y VS JUNE +8.0%

- MNI: JAPAN JULY CPI FOOD EX-PERISHABLES +4.3% Y/Y; JUNE +4.1%