Of the four regional manufacturing surveys released to date for September, all show manufacturing expansion.

The market was expecting a range between 4 to 10 (consensus 8) versus the actual at 3.

GROWTH IN TENTH DISTRICT MANUFACTURING ACTIVITY EDGED HIGHER

The Federal Reserve Bank of Kansas City released the September Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity edged higher, and producers’ expectations for future activity maintained their recent solid levels.

“We saw slightly faster growth this month after a sizable easing in August,†Wilkerson said. “This is despite continued sluggish activity in our important food processing segment, driven in part by higher beef costs this year.â€

TENTH DISTRICT MANUFACTURING SUMMARY

Growth in Tenth District manufacturing activity edged higher in September, and producers’ expectations for future activity maintained the solid level of the previous survey. Price indexes showed a mild decline from the previous month, and expectations for future price growth were mixed. Several firms continued to comment about difficulties finding qualified labor, resulting in some wage pressures.

The month-over-month composite index was 6 in September, slightly higher than 3 in August but lower than 9 in July. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The growth in manufacturing activity continued to occur primarily at durable goods-producing plants. Nondurable goods-producers experienced only a modest rise, with activity at some food processing plants continuing to decline in the face of higher beef prices. The production index increased from 4 to 12, and the shipment index also grew from a reading of 2 in August to 14. The employment index increased significantly from -4 in the last survey period to 7 in September. Most other month-over-month indexes eased compared to August’s readings. The new orders and backlog of orders indexes both declined modestly. The inventory indexes also both experienced moderate declines, with materials now at -6 and finished goods at -1.

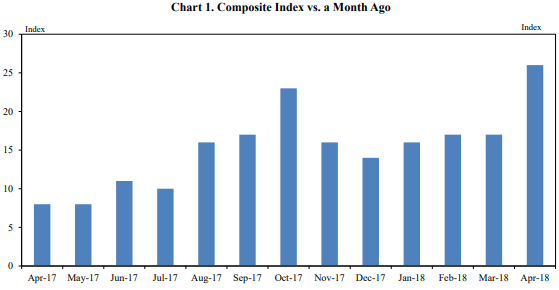

Year-over-year factory indexes were mostly higher this survey period. The composite year-over-year index rose to 15, as compared to the previous survey reading of 13. The production index was moderately higher at 14, while capital expenditures and backlog of orders were also moderately higher. The volume of shipments index increased from 10 to 16 and the materials inventory increased from 15 to 18. The volume of new orders and number of employees were also slightly higher. Conversely, supplier delivery time and finished goods inventories indexes were lower at 12 and 8, respectively.