Back in June 2011, Zero Hedge first posted:

which we followed up on various occasions, most notably with

- “How The Fed’s Latest QE Is Just Another European Bailout” and

- “The Fed’s Bailout Of Europe Continues With Record $237 Billion Injected Into Foreign Banks In Past Month.”

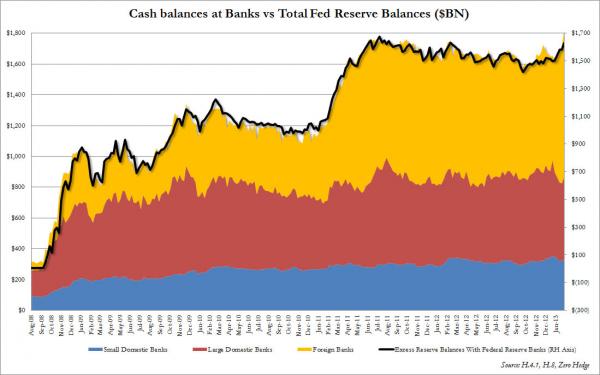

With the following key chart:

Of course, the conformist counter-contrarian punditry, for example the FT’s Alphaville, promptly said this was a non-issue and was purely due to some completely irrelevant microarbing of a few basis points in FDIC penalty surcharges, which as we explained extensively over the past 3 years, has nothing at all to do with the actual motive of hoarding Fed reserves by offshore (or onshore) banks, and which has everything to do with accumulating billions in “dry powder” reserves to use for risk-purchasing purposes (alas understanding that would require grasping that reserves are perfectly valid collateral to use as margin against purchase of such market moving products as e-mini futures, which in turn explains why traders usually don’t end up as journos).

Fast, or rather slow, forward to today when none other than the WSJ’s Jon Hilsenrath debunks yet another “conspiracy theory” and reveals it as “unconspiracy fact” with “Fed Rate Policies Aid Foreign Banks:Fed Rate Policies Aid Foreign Banks:“

Wait… the Wall Street Journal said that? Yup.

Banks based outside the U.S. have been unlikely beneficiaries of the Federal Reserve’s interest-rate policies, and they are likely to keep profiting as the Fed changes the way it controls borrowing costs.

Â

Â

Foreign firms have received nearly half of the $9.8 billion in interest the Fed has paid banks since the beginning of last year for the money, called reserves, they deposit at the U.S. central bankaccording to an analysis of Fed data by The Wall Street Journal. Those lenders control only about 17% of all bank assets in the U.S.

Â

Moreover, the Fed’s plans for raising interest rates make it likely banks will see those payments grow in coming years.

Hmm, we almost feel like we should bring up the dreaded “P” word considering the bolded sentence is a recap of what we said in February of 2013 in “How The Fed Is Handing Over Billions In “Profits” To Foreign Banks Each Year.” That’s ok, though: imitation, flattery and all that…

So here is Hilsy “figuring out” what we have been explaining for over 3 years!

Though small in relation to their overall revenues, interest payments from the Fed have been a source of virtually risk-free returns for foreign banks. Large holders of Fed reserves include Deutsche Bank, UBS AG, Bank of China and Bank of Tokyo-Mitsubishi UFJ, according to bank regulatory filings. U.S. banks including J.P. Morgan Chase, Wells Fargo and Bank of America Corp. are also big recipients of Fed interest payments, according to the filings.

Â

“It is a small transfer from U.S. taxpayers to foreign taxpayers,” said Joseph Gagnon, a former Fed economist at the Peterson Institute for International Economics. The transfer, he added, was a side effect of Fed policy, not a goal.