I’m not a prophet of doom but I’m accumulating cash. I’m selling any stock that is trading below its 100 day moving average and I’m not replacing anything in my personal portfolios. I have an optimism/pessimism index and right now that index is at a negative. I truly believe that in the short run – at least until after the mid-term elections; there is more downside risk to being in the market than there is upside risk to be sitting on the sidelines with your powder dry. Let me document why I think that way.

Let’s look at the Market as a whole:

As I write this post just how many stock are trading below their moving averages?

- 83.40% are below their 20 day moving average

- 74.47% are below their 50 day moving average

- 69.32% are below their 100 day moving averages

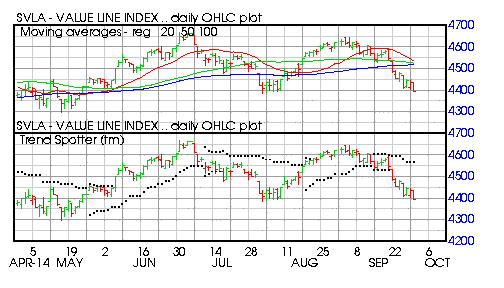

I use the Value Line Arithmetic Index as my Market proxy because it contains 1700 stock, well over 95% of the entire capitalization of the US stock market and it equally weights all stocks – the big boys do not overly influence this Index:

Barchart technical indicators:

Â

- 56% Barchart technical sell signals

- Trend Spotter sell signal

- Below its 20, 50 and 100 day moving averages

- 5.89% off its recent high

- Relative Strength Index 32.60%

I like to stratify the Market by separating the Large Cap, Mid Cap, Small Cap and Micro Caps. The easiest was to do that is to analyze 4 market cap ETF’s:

S&P 500 Large Cap Index ETFÂ (NYSEARCA:IVV)

Barchart technical indicators:

Â

- 24% Barchart technical sell signals

- Trend Spotter sell signal

- Below its 20, 50 and 100 day moving averages

- 3.20% off its recent high

- Relative Strength Index 39.08

S&P 500 Large Cap Index ETFÂ (NYSEARCA:IJH)

Barchart technical indicators:

Â

- 48% Barchart technical sell signals

- Trend Spotter sell signal

- Below its 20, 50 and 100 day moving averages

- 5.91% off its recent high

- Relative Strength Index 30.15%