About 36 months ago Ireland’s two-year notes were yielding 14% and its government and the Brussels apparatchiks were scrambling with tin cup in hand to stave off disaster. Now their yield is negative 0.01%.

Mirabile dictu!

Yes, a wonder to behold—but not one I can explain. Better it’s left to the experts in today’s bizarro world of maniacal central banking. That is, with the reminder that the ECB has now set its deposit rate at negative 0.2%, here’s how Goldman explained the Irish note miracle to the WSJ:

If “you buy short-dated Irish or French paper and pay less [than depositing at the ECB], you’re improving your net income, even if the yields are still negative,â€Â said Jonathan Bayliss, a managing director for global government bonds at Goldman Sachs Asset Management in London.

That’s right, down is the new up. The price and yield of government bonds no longer have anything to do with risk or economics; it’s all about central bank machinations. Actually, it’s all about the speculator driven momentum surges that are triggered by central bank maneuvers.

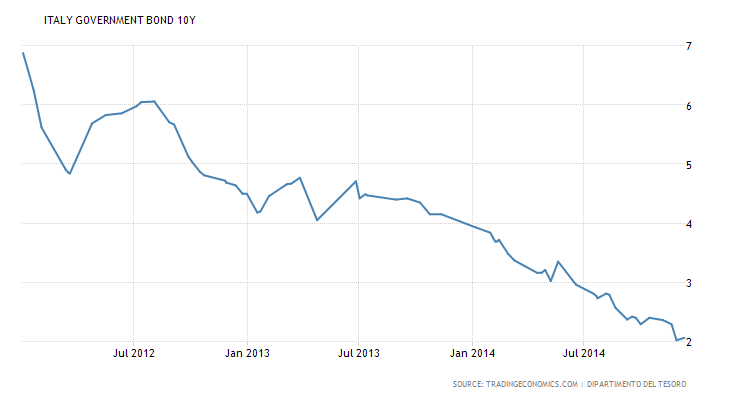

As is well known, Draghi’s “whatever it takes†pronouncement triggered the most blistering bond rally in recorded history. Leveraged speculators have literally made triple digit returns since July 2012 in the notes of still debt-besotted basket cases like Spain, Italy and Ireland.

Indeed, in its breathless reporting on the miraculous recovery of the European bond market, the WSJ noted that red hot returns are still being earned two years after the fact—- as Draghi hints ever more strongly that a tsunami of ECB bond buying is just around the corner. During the last 9 months alone, punters have made double-digit returns on the debt of Italy and Spain—both of which are barely treading economic water and sinking deeper under the burden of public debt: