In is only fitting that a week that has been characterized by deteriorating macroeconomic data, and abysmal European data, would conclude with yet another macro disappointment in the form of Markit’s sentiment surveys, for non-manufacturing/service (and composite) PMIs in Europe which missed almost entirely across the board, with Spain down from 58.1 to 55.8 (exp. 57.0), Italy down from 49.8 to 48.8 (exp. 49.8), France down from 49.4 to 48.4 (exp. 49.4), and in fact only Russia (!) and Germany rising, with the latter growing from 55.4 to 55.7, above the 55.4 expected, which however hardly compensates for the contractionary manufacturing PMI reported earlier this week. As a result, the Composite Eurozone PMI down from 52.3 to 52.0, missing expectations, as only Germany saw a service PMI increase.

Goldman’s take: “Bottom line: The September Euro area Final Composite PMI came in at 52.0, 0.3pt weaker than the Flash (and Consensus) estimate. Relative to August, the Composite PMI declined by 0.5pt. The weaker Final Composite PMI was driven by a downward revision to the French Final service PMI. Today’s data also showed a decline in the Italian and Spanish service PMI.”

From Chris Williamson, Chief Economist at Markit said:

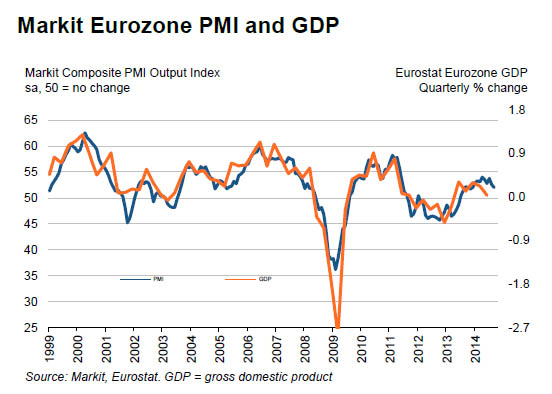

“The PMI suggests the eurozone economy remained stuck in a rut in the third quarter. After GDP stagnated in the second quarter, we can only expect modest growth of 0.2-0.3% in the third quarter based on these survey readings, with momentum being lost as we head into the final quarter of the year.

“There are certainly pockets of growth: Ireland’s economy is recovering strongly, Spain is seeing a still-robust upturn and the German service sector is providing an important prop to growth in the region as a whole. But the overall picture is one of a euro area economy that is struggling against multiple headwinds. These include a lack of domestic demand in many countries, subdued bank lending, sanctions with Russia and a reluctance of companies to expand in the face of an uncertain economic outlook.

“The survey showed growth of new orders sliding to the weakest for almost a year across the region as a whole, suggesting demand for goods and services is barely growing. Employment was held more or less unchanged again as a result, and a weakening in firms’ backlogs of orders suggests we could see headcounts start to fall again in coming months if this lack of demand persists.

“The waning of growth signalled by the PMI will apply further pressure on the ECB to broaden the scope of its planned asset purchases, to not only buy riskier asset-backed securities but to also start purchasing government debt.â€

In other news, bad news apparently is back to being good news. So despite or rather thanks to this ongoing economic weakness, futures have ignored all the negatives and at last check were higher by 9 points, or just over 0.4%, as the algos appear to have reconsidered Draghi’s quite explicit words and BlackRock’s even more explicit warning that a public QE is just not coming, and seem to be convinced that his lack of willingness to commit is merely “pent up” commitment for a future ECB meeting. That or, more likely just another short squeeze especially with the “all important” non-farm payrolls number due out in just over 2 hours, which for the past 24 hours has been hyped up as sure to bounce strongly from the very disappointing, sub-200K August print.

Speaking of payrolls, the August jobs data better be revised much higher or all those pundits, with an emphasis on Mark Zandi, who said the BLS will have no choice but to revise the August print, will appear even more foolish than they already are.