As JPMorgan Nikolaos Panigirtzoglou explains,

The rising bond ownership by central banks has not only eroded bond overweights but has also made private non-bank investors very overweight credit. This is because QE programs like those of the Fed/BoE/BoJ, have mostly focused on government related bonds. Effectively G4 central banks have been “soaking up†government bonds forcing private investors to hold more corporate bonds. In addition FX reserve managers continue to focus their purchases on government related bonds with corporate bonds accounting for only 3.5% of their total bond holdings, according to stock data on foreign official institutions holdings of US securities reported by the US Treasury.

How big is this credit overweight? To answer this question, we calculate how much of the $24tr of tradable bonds held by non-bank entities is non-government related, i.e. corporate bonds. Given that almost the entire $7tr bond portfolio held by G4 central banks is government-related, only 3.5% of the FX reserve managers bond portfolio is invested in corporate bonds and around 60% of G4 commercial banks’ bond portfolio is invested in non-government bonds, we calculate that non-bank entities globally hold $13tr of non-government bonds out of their $24tr portfolio of tradable bonds. That is, 55% of their bond portfolio is invested in non-government or corporate bonds. This compares to a 38% weight of non-government bonds in the tradable bond universe of the Barcap Multiverse index augmented by Munis and Inflation linked bonds.

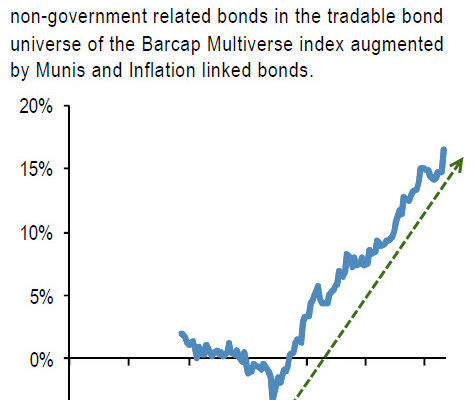

That is non-bank investors are implicitly overweight credit by 55%-38%=17% (Figure 3). This compares to a neutral weighting in 2009Â (zero in Figure 3).

That is successive QE programs since 2009 have made private non bank investors increasingly more overweight credit.

Admittedly the ECB’s asset purchase program is different as it focuses on securitized and covered bonds rather than government bonds, at least at its early stages. So in principle the ECB purchases could somewhat reduce the credit overweight in Figure 3 at least for Euro based investors. But to the extent that the ECB mostly purchases these securitized and covered bonds from banks, the impact on non-bank investors’ positioning should be very limited. In addition the ECB purchases, projected at €400bn over two years, are too small relative to previous QE programs by the Fed / BoE / BoJ to reverse the rising trend of Figure 3.