Recently there have been numerous major economic agencies warning of the growing and severe risks in the debt markets. Investors have shrugged them off as they seem to think that their bond fund is immune as are equities. They’re not.

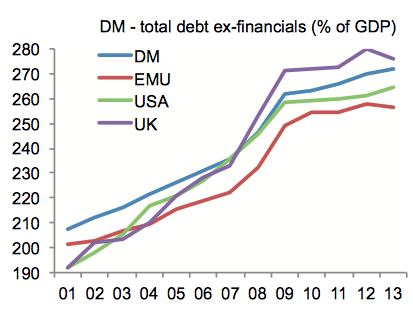

The Geneva Report, released last month, revealed that there has been no progress made in reducing debt levels around the world in the years since the financial crisis. In fact, debt levels have only grown over that time, even here in the US. This should be worrisome, they report, because, “there is considerable evidence that a high stock of debt increases vulnerability to the risk of a financial crisis.â€

Chart via Geneva Report

Clearly, the BIS is looking at the same research because back in July they warned these growing debt levels could kick off ‘another Lehman.’ BIS General Manager, Jaime Caruana, told the Telegraph, “We are watching this closely. If we were concerned by excessive leverage in 2007, we cannot be more relaxed today.â€

This week, the IMF joined the chorus:

…Prolonged monetary ease has encouraged the buildup of excesses in financial risk-taking. This has resulted in elevated prices across a range of financial assets, credit spreads too narrow to compensate for default risks in some segments, and, until recently, record-low volatility, suggesting that investors are complacent. What is unprecedented is that these developments have occurred across a broad range of asset classes and across many countries at the same time.

For all of these bankers, economists and regulators, there’s just too much debt for their liking and much of it carries too much risk – and it’s spread beyond the debt markets to a broad variety of other asset classes. That’s funny because even the Fed has been warning about the very same thing lately! And they’ve pointed their finger directly at the leveraged loan market.