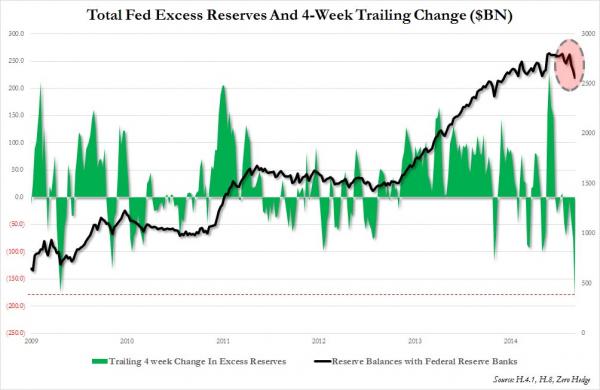

While we understand the Fed’s desire to pass the monetization baton seamlessly from the end of QE3 in the US, to the expansion of QE in Japan first, and then the launch of public QE by the ECB, things may not be quite as smooth as desired . Because a quick glance at the latest Fed H.4.1 statement reveals something unexpected: in the past 4 weeks, the level of total reserves with Fed banks (i.e., excess reserves created by QE), have seen their biggest plunge since the launch of QE in March of 2009. As of November 5, the total amount of outstanding reserves tumbled to $2.561 trillion, down a whopping $188 billion in the past 4 week, well below the $2.8 trillion recorded in August, and at a level last seen in February 2014.

Yet when looking at the corresponding cash balances of banks, something which as we have shown in the past is directly driven by the total amount of systemic reserves, there is no comparable drop in total cash, as can be seen on the chart below.

Unexpectedly, the difference between total bank cash balances as reported weekly by the Fed’s H.8 statement, and the total amount of excess reserves has blown out the most observed under the Fed’s central planning regime starting in 2009.

Digging into the components reveals what most should expect: the cash balances of foreign banks operating in the US suddenly soared to a record high $1.537 trillion even as the cash of large domestic banks operating in the US tumbled to $1.1 trillion, accounting for almost the entire drop in Fed reserves! In fact, the total cash parked at foreign banks is greater than that located at domestic (large and small) banks by $100 billion, clost to the highest ever.

So what does this mean? There are several possible explanations:

- the drop in reserves could be simply a calendarization effect, as the Fed is unclear how to seasonally adjust total actual reserves at a time when QE3 has just ended and the Fed’s balance sheet is flat.

- there has indeed been a drop in reserves, as domestic banks proceed to finally do what the Fed has been begging them to do for 5 years: lend the cash out. Then again, since there has been a matched collapse in total bank deposits, sliding by over $50 billion in the past week to $10.253 trillion, this is hardly the case if only for now.

- as the reserve drop has moved through the domestic banking sector, foreign banks have seen their domestic cash replenishhed courtesy of offshore QE activity, be it by the BOJ or to a lesser extent, the ECB.