Back in September, when the results of the first much-trumpeted TLTRO were announced, everyone said it was a clear disappointment, when European banks expressed just €82.6 billion in ECB credit demand, far below the €100-€300 billion range expected…

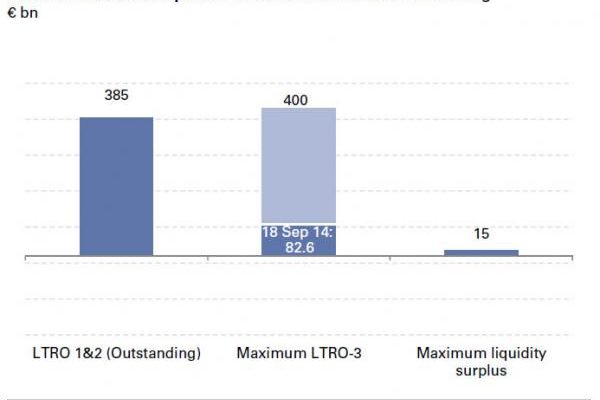

… and well below the €400 billion across the two 2014 TLTROs hinted by Mario Draghi. Today, we got the second TLTRO-3 result which too, was a flop, if not quite the disaster the first one was, when the ECB announced that just €129.84 billion was allotted in today’s TLTRO result, spread among 306 counterparties, or 51 more than the bidder who signed up for the first TLTRO, resulting in an aggregate take up for both auctions of only €212 billion, which also happens to be €55 billion, or 21%, below the consensus expectations observed in a Goldman poll back in September 9, €40 billion below the Bloomberg median consensus estimate of €170 billion for the second TLTRO, and half the total cap of €400 billion.

More improtantly, unless there is a massive surge in the TLTRO-4 scheduled for 2015, the liquidity gap from the winding down LTRO 1&2 is only set to increase: it is already at a sizable -€59 billion.

Then again, with every ECB operation so far being a disappointment, considering only €21.5 billion in liquidity has been injected into the system via the ECB’s ABCPP and Covered Bond purchase programs, and so far the TLTRO tracking at just about half of official expectations, this was promptly spun as great news for Europe as it means ECB public debt QE is inevitable. Recall what we said three months ago:

In fact, the less TLTRO taken up, the higher the push back to the ECB to do more private and public QE on its own!

Now if only Mario Draghi did not have an open revolt on his own board and if he had the backing of the EU (and Germany it goes without saying), then all would be well. In fact, judging by the kneejerk reaction, it would appear even the EUR isn’t so sure public QE is imminent, after it dropped to session lows of 1.2414 on the result, only to resume its drift higher.