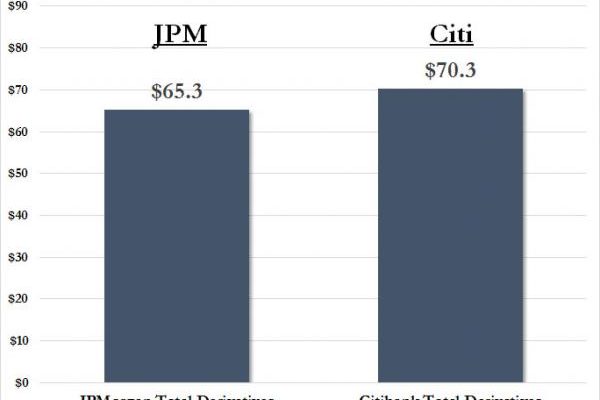

Earlier today (Monday Jan. 5), when we were conducting a routine check with the Office of the Currency Comptroller’s on the total notional amount of derivatives held at the Big 4 banks in the context of the “JPMorgan break up” story, we found something stunning: using the latest, just released Q3 OCC data, JPMorgan (JPM) is no longer America’s undisputed derivatives king. Well, it still is at the HoldCo level, where it is number one in terms of notional derivatives with $65.5 trillion, but when one steps a level lower, namely the FDIC-insured commercial bank (the National Association or N.A.) level, something quite disturbing emerges. This:

As the chart above, which references Table 1 in the Q3 OCC report, shows Citigroup (C), or rather its FDIC-insured Citibank National Association entity, just surpassed JPM and is now the biggest single holder of total derivatives in the US. Furthermore, as the charts below show, while every other bank was derisking its balance sheet, Citi not only increased its total derivative holdings by $1 trillion in Q2, but by a whopping, and perhaps even record, $9 trillion in the just concluded third quarter to $70.2 trillion!

Here is Citi in context:

What is the reason for the surge in total derivative exposure? Was it futures, options, forward or CDS? Neither. The answer: OTC traded swaps…

… which soared by $5 trillion in Q2 and over $8 trillion – or a massive 20% in just one quarter – in Q3 to a whopping $49 trillion, $16 trillion more than the OTC swaps held by JPMorgan or Goldman Sachs (GS), and more than double the swaps held by Bank of America (BAC)!

And that’s not all: perhaps what is most bizarre is that Citigroup is the one bank whose HoldCo holds less derivatives, or $64.8 trillion, than its FDIC-insured N.A. OpCo which has $70.3 trillion in derivative notional exposure. For those wondering: this was not the case in the second quarter when the HoldCo ($61.8 trillion) held more derivatives than Citi’s FDIC-insured bank ($61.1 trillion).