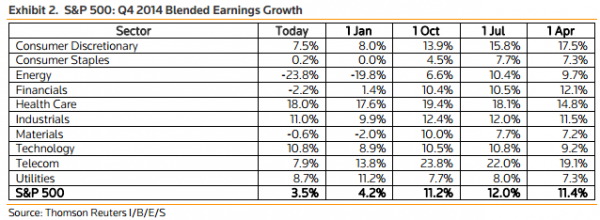

On the surface, despite concerns about the adverse impact from the strong dollar and crashing energy earnings, so far the fourth quarter is shaping up quite strong. Indeed, as CNBC won’t stop repeating, with 7% of the companies in the S&P 500 (SPY) reporting actual results for Q4 to date, more companies are reporting both actual EPS above estimates (84%) and actual sales above estimates (60%) compared to recent historical averages. Of course, this only works courtesy of the endless guide-down game that analysts and corporate CFOs play year after year, in their appeal to gullible investors that companies are actually doing better than expected, as the following chart, courtesy of @Not_Jim_Cramer, shows, in which we can see that in Q1 2014 the S&P was expected to grow by 11.4%, a number which has plunged to just 3.5% currently.

Â

However, where the fiction falls apart, is when moving away from this cherry-picked “bottoms-up” version of reality, where the sheer number of beats is supposed to give if not now-extinct carbon-based traders, then at least algos a warm, fuzzy feeling.

What happens when one looks at earnings and revenues on a “top-down”, consolidated basis? The answer, courtesy of Factset, is far less pleasant:

In aggregate, companies are reporting earnings and revenue below expectations to date. The aggregate dollar-level earnings reported by these 37 companies is 0.4% below the aggregate dollar-level earnings estimated for these 37 companies. The aggregate dollar-level revenue reported by these 37 companies is 1.2% below the aggregate dollar-level revenue estimated for these 37 companies.

As a result, even though more companies have beat earnings and revenue estimates to date than missed earnings and revenue estimates, the surprise percentage (which reflects the aggregate difference between actual results and estimated results) is negative for both earnings (-0.4%) and revenue (-1.2%).