REITs have been a hot sector in a volatile stock market. With share prices soaring in January, upcoming yields on these three stocks will be driven down greatly impacting every income investor owner. Now is the time to sell these stocks, take your gains, and reinvest elsewhere in the market where the yields are more attractive.

Consider these numbers. A U.S. REIT index is up 39% in the last year. Since a mid-September small pullback, REITs have gained 20%. And in the month of January, REITs as a group are up 9%. These gains are great if you own REITs, but higher share prices means yields have dropped, and if you are an income focused investor it may be time to take some profits out of your top REIT gains and reinvest the proceeds to generate a higher level of cash income.

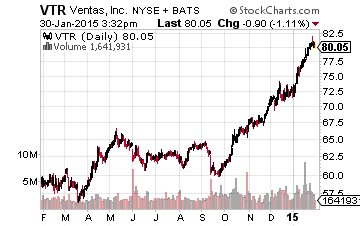

Healthcare REIT Ventas, Inc. (NYSE: VTR) has been a portfolio holding in The Dividend Hunter since May. Ventas is a great company, possibly the best run healthcare REIT. My concern with VTR is not about the company, but with the valuation.

Since mid-September, just after the third quarter dividend was paid, the VTR share price has increased by 30%. In mid-September the stock carried a 4.8% yield. Now, even with an 8% dividend increase in December, VTR yields just 3.9%. At this low yield, the risk of a drop in share price is significantly greater than the potential for continued share price gains.

My recommendation to my subscribers to The Dividend Hunter was to sell VTR and reinvest the proceeds into another high quality, dividend growth stock with a higher current yield. The new stock recommendation in the newsletter yields 4.5%, but by taking the big share price gains on VTR and reinvesting that cash into the higher yielding stock, subscribers will see a 22% increase in dividend income in 2015. The replacement stock also will grow dividends at a faster rate.

Here are a couple more popular REITs that have seen yields driven down by rapidly increasing stock prices.