Media Credit: Bloomberg

I get fascinated at how we never learn. Well, “never†is a little too strong because the following article from Bloomberg, Meet the 80-Year-Old Whiz Kid Reinventing the Corporate Bond had its share of skeptics, each of which had it right.

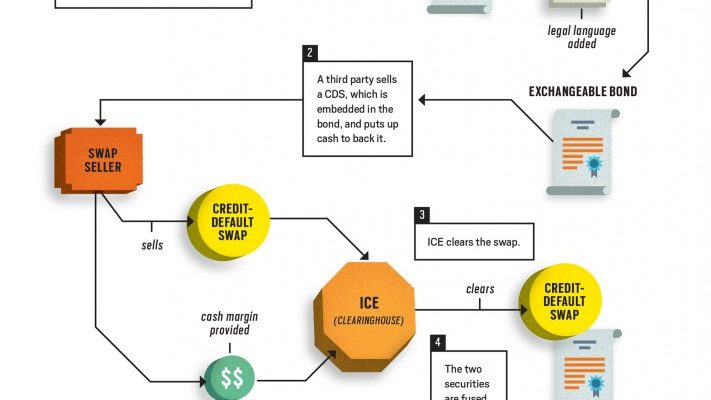

The basic idea is this: issue a corporate bond and then package it with a credit default swap [CDS] for the same corporate bond, with the swap cleared through a clearinghouse, which should have a AAA claims-paying ability.  Voila! You have created a AAA corporate bond.

Or have you?  Remember that bond X guaranteed by Y has many similarities to bond Y guaranteed by X, because both have to fail for there to be a default.  I used to help manage portfolios that had many different types of AAA bonds in them.  Some were natively AAA as governments, quasi-governments (really, Government Sponsored Enterprises) like Fannie and Freddie, or corporations.  Some were created by insurance guarantees from MBIA, Ambac, FGIC, or FSA.  Others were created via subordination, where the AAA portion took the losses only if they were greater than a highly stressed level.  Lesser lenders absorbed lesser losses in exchange for the ability to get a much greater yield if there was no default.

There is a lot of demand for AAA bonds if they have a high enough yield spread over Treasuries. Â The amount of spread varies based on the structure, but greater complexity and greater credit risk tend to raise the spread needed. Â Here are some simple examples: At one time, you could buy GE parent corporate bonds rated AAA, or GE Capital corporate bonds with an identical rating, but no guarantee from GE parent. Â The GE Capital bonds always traded with more yield, even though the rating was identical. Â AIG had a AAA credit rating, but its bonds frequently traded cheap to other AAA bonds because of the opacity of the financials of the firm (and among some bond managers, a growing sense that AIG had too much debt).