If yesterday’s newsflow was bizarre, then today’s market reaction has been outright surreal, and the day hasn’t even really started.

First, weeks after the ECB’s folded on Europe’s deflationary specter and what is now seen by most as an all out triple-dip recession in the Eurozone, where only the endless adjustment of the definition of GDP has prevented this from flowing through to the bottom line, and hours after the ECB implicitly did everything in its power to create a banking panic in Greece, risking an all out Grexit and much worse down the line, the European Union decided that it was time perfect time to, drumroll, raise European growth forecasts!

According to the WSJ, “the European Union’s official economists said the sharp drop in global oil prices and a weaker euro should boost growth in the eurozone this year, raising their forecasts for the currency area’s largest economies.”

The economists at the European Commission, the EU’s executive arm, said the eurozone should grow 1.3% this year and 1.9% in 2016. In November, they expected growth of 1.1% this year and 1.7% next. The commission raised its growth estimates for most of Europe’s largest economies, including Germany, France and Spain.

“Europe’s economic outlook is a little brighter today than when we presented our last forecasts,†said Pierre Moscovici, the European economics commissioner. “The fall in oil prices and the cheaper euro are providing a welcome shot in the arm for the EU economy.â€

And then, as always in the case of Europe (whose central bank conducted a stress-test with a worst case that excluded deflation as a possible outcome when two months later the same ECB launched bond buying precisely to prevent deflation), it immediately shot itself in the foot, explaining just why these forecasts are already null and void:

The cutoff date for the forecasts is Jan. 23. The left-wing Syriza party was swept to victory in the Greek elections two days later on a platform of getting Greece’s official creditors to loosen austerity mandates on the country and restructure its debt. So far, Germany and others eurozone nations have refused. The commission did lower its forecasts of Greek growth, saying the decision to call early elections had hurt confidence.

Worse, the forecasts “don’t account for the threat that the crisis could return in full force now that the eurozone is again headed for a showdown with Greece, which is asking the bloc’s other members to rewrite the bailout plan they signed with Athens.” The result: “The commission cut its estimates for the Greek economy. Growth is expected at 2.5% this year, down from a November estimate of 2.9%. “The growth momentum was fairly firm in the second half of 2014, although the early election has affected confidence and investment,†the commission said.”

2.5% growth in Greece in 2015: remember that. Or rather, forget it.

In other words, just your usual run-of-the-mill propaganda by an artificial monetary and political block which has all but run out of “political capital.”

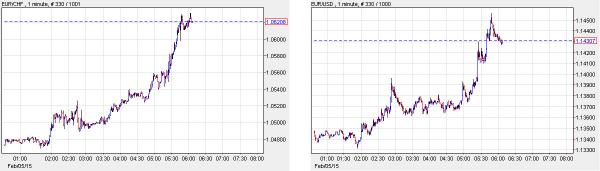

However, the same block has not run out of printer ink. The reason being that just before Europe came in to start trading in the aftermath of yesterday’s ECB shocker which has since seen Greek bank stocks and bonds tumble yet again, a day which absent some hail-mary from the central banks, would have been a total bloodbath, someone started buying EUR crosses particularly the EURCHF and EURUSD, and buying, and buying, and buying more…

… until finally that someone was rumored to have been revealed as the Swiss National Bank, the same bank which - as we wrote yesterday – had doubly lost the markets’ confidence after not only did it end its hard CHF ceiling, but three weeks later, saw its “soft ceiling” in the form of the EURCHF 1.05-1.10 corridor breached as well.

In other words, one central banks shoots itself in the foot by trying to make a very explicit political statement to a rebelious Greece, and another central bank is supposed to bail it out, a central bank that has become a hedge fund with a nominal losing FX position that is fast approaching the entire GDP of Switzerland.

Call it unintended consequences of “style drift.”

So what else is going on? A quick recap courtesy of RanSquawk and Bloomberg

The Headlines:

- Greek negotiations remain the dominant theme with European equities in the red and Athens Stock Exchange opening 8.9% lower

- EU commission forecasts: Euro area 2015 GDP 1.3% (Prev. 1.1%), 2015 CPI 0.1% (Prev. 0.8%), 2015 unemployment 11.2%

- Looking ahead, at 1130GMT/0530CST the Greek and German finance ministers are scheduled to brief the press, with the BoE rate decision, ECB’s Praet and Knot all scheduled later today. Out of the US there is Challenger job cuts, weekly jobs numbers and the December trade balance data

- Treasury yields slightly higher in overnight trading; yields have been rising amid firm U.S. economic data and rebounds from record lows reached last week by U.K., German and Japanese 10Y yields.

- Greece lost a critical funding artery as the ECB restricted loans to its financial system, raising pressure on the government to yield to German-led austerity demands to stay in the euro zone

- “The decision of the newly elected Greek government to stop cooperating with the Troika shows how unpopular sharing sovereignty rights with foreign creditors is, even in cases in which national expenditures are largely dependent on external financial help,†ECB’s Jens Weidmann said

- The European Commission raised its euro-area growth forecasts and cut its inflation outlook as cheaper energy proves both a blessing and a curse

- CME Group Inc. will close most of its futures pits in Chicago and New York by July 2, with open outcry trading dwindling to just 1% of CME volume

- The Fed is stepping up efforts to fend off congressional audits of its policies, with one official warning they would constitute a threat to its independence; Sen. Rand Paul (R-KY) last month re-introduced an audit bill

- RadioShack Corp. is closing in on an agreement with creditors and other parties that would put the retailer in bankruptcy as soon as today, people with knowledge of the discussions said

- Weatherford Intl plans to cut 5,000 positions by the end of the first quarter, joining its larger competitor Schlumberger Ltd. in responding to lower oil prices

- Sovereign yields mixed, Greece 10Y rises ~62bps to 10.30% Portugal, Spain and Italy also higher. Asian stocks mixed; European stocks mostly lower, U.S. equity-index futures rise. Brent, WTI rise; copper and gold fall