The vast majority of financial and investing literature discusses what and when to buy and how to build and your portfolio. The topic of when to sell is discussed much less. I believe this is because buying stocks is exciting. We think about how much money we can make in an investment, or how the dividend payments will grow. When you sell a stock it is either because you believe there is a better investment available elsewhere, or you need to use the money tied up in the investment for another purpose. This is decidedly less exciting than the prospects of making money buying a new stock.  This article discusses when to sell dividend stocks using The 8 Rules of Dividend Investing.

Two Reasons to Sell Dividend Stocks

Rules 6 & 7 of The 8 Rules of Dividend Investing discuss specifically when to sell a dividend stock. Rule 6 is called “The Overpriced Ruleâ€. As you may have guessed, it applies to stocks that are trading far above fair value. Rule 8 is called “The Survival of The Fittest Ruleâ€. This rule applies to stocks that are in danger of losing or have lost their competitive advantage and are no longer able to maintain dividend payments. Each of the two sell rules are discussed in detail below.

Sell Rule 1:Â The Overpriced Rule

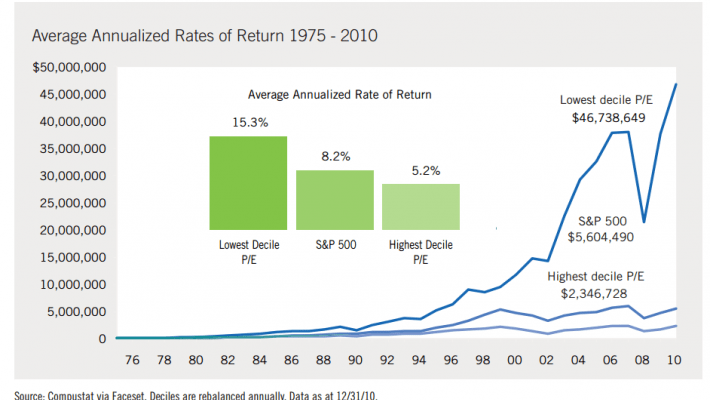

The first Sure Dividend sell rule is to sell dividend stocks with a normalized price-to-earnings ratio above 40. Stocks with high price-to-earnings ratios have historically significantly underperformed stocks with low price-to-earnings ratios. The image below shows the performance of high price-to-earnings stocks versus low price-to-earnings stocks over a 35 year period.

Source:Â The Case for Value by Brandes Investment Partners

The highest priced stocks have significantly underperformed the market. The normalized price-to-earnings ratio of 40 is used as a cut-off because that is the peak (or very close to it) valuation that the entire S&P 500 has reached. A dividend stock with a price-to-earnings ratio of 40 is extremely likely to be overvalued.