Following a quiet overnight session in which the main event appears to be a statement by Chinese premier Li for more active fiscal policy, which has pushed the metals complex higher, although technically every other asset class as well, with US equity futures set to open in fresh record high territory, even as 10Y yields around the world continue to decline, attention today will fall on the CPI print due out shortly, because if consensus is correct, January will be the first month this decade when US inflation posts a negative print, mostly due to the delayed effect of sliding commodity prices.

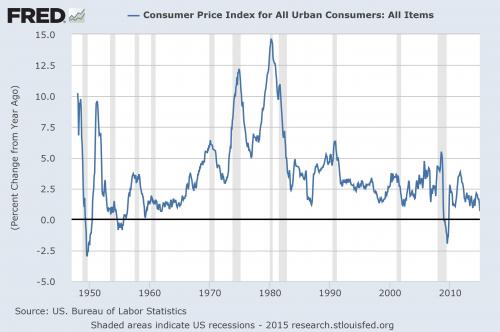

As Deutsche recaps, the most important number today is the headline CPI where the headline YoY rate is predicted to be negative by the market (-0.1%) for the first time since 2009. Over this period the YoY rate stayed negative for 8 months. However before this we hadn’t seen a full year decline since August 1955. So these continue to be unusual times and with very few predicting inflation successfully over the last few months or even years it is hard to say with certainty where the bottom will be and how steep a recovery we’ll see. The Fed are amongst those who have not predicted inflation very well and the main issue with a rate rise this summer is that it appears based on faulty forecasts of a recovery in CPI-measured inflation. In other words, a few months before what may be the first US rate hike for a new generation of traders, the US is set to print its first annual deflation since Lehman, transitory or not.

European equities trade in positive territory with today’s session being particularly light in terms of macro newsflow. Nonetheless, on a sector specific basis, energy names initially led the way higher for Europe after WTI crude futures managed to hold above USD 50bbl after breaking above the handle yesterday. However, heading into the North American crossover, basic material names jumped to the top of the pile as precious metals managed to extend on their recent gains. In fixed income markets, Bunds saw an early bout of strength as European equity futures came off their best levels, with the Mar’15 future printing a fresh contract high in the wake of yesterday’s substantial gains. Elsewhere, Portugal was the latest nation to see their 10yr yield break below 2% for the first time with Italian, Dutch and Irish 10yr paper already printing record lows this week. Nonetheless, volumes for the Bund remain relatively light with participants awaiting key tier 1 data release from the US at 1330GMT.

Hang Seng (+0.5%) and Shanghai Comp (+2.1%) outperformed on speculation of further PBoC easing measures, after Chinese Premier Li called for more active economic policy. However, gains for the Hang Seng were trimmed after S&P lowered their 2015 Chinese GDP growth forecast to 6.9% from 7.1%. Nikkei 225 (+1.08%) posted fresh 15-yr highs underpinned by JPY weakness, of note S&P reduced Japan’s 2015 GDP growth forecast to 0.7% from 1.3%.

Overnight, AUD was dragged lower after Q4 Australian Capex data (Q/Q -2.2% vs. Exp. -1.6% (Prev. 0.2%) saw a 2nd consecutive decline. This prompted markets to push ahead expectations for a 25bps RBA rate cut next week, with odds now at 53% vs. 38% before today’s data. Nonetheless, AUD was granted some reprieve heading into the European open following the upside in metals markets, this also benefited CAD with USD/CAD slipping below 1.2400. Elsewhere, NZD was able to hold onto its gains following its surprise trade surplus, while the fall in US yields saw USD/JPY break below its 50DMA seen at 118.79.