As Mario Draghi unleashes his trillion euro bond buying program – aimed from what we are told, at lowering risk premia in credit markets to stimulate the eurozone’s economy from utter stagnation – things are not going according to plan. Away from Greece, peripheral bond spreads are all up 8bps on the day and stock indices are mixed on this first day of DOMO (Draghi Open Market Operations) Of course, the other reason for Q€ is to implicitly (because one would never explicitly admit to joining the currency wars) devalue the currency – thus improving competitiveness and exports for the EU; but that’s not working out so well as Germany’s exports dropped and missed by the most since August... this was not supposed to happen.

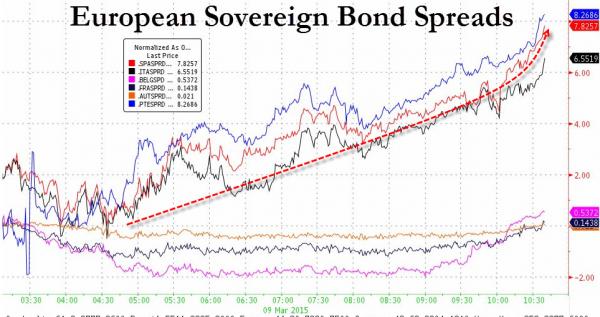

European Sovereign Bond risk surges…

*Â *Â *

None of this should be a surprise – remember what happened the last time the ECB bought sovereign bonds…

Spanish and Italian bond yields (upper pane) blew wider as the volume of ECB bond buying (lower pane) picked up…

*Â *Â *

and then there is Q€ will lower the Euro and improve EU competitiveness… Nope!!

None of this was supposed to happen… the textbooks said…