As a value investor, I’m a little frustrated these days. There is virtually nothing cheap anywhere in the public markets. Stocks are expensive, trading at cyclically-adjusted price earnings ratios higher than those before the 1929 and 2008 crashes. And the 10-year Treasury yield—even after its recent surge—is barely 0.4% above the core inflation rate.

Yet there is one corner of the market still showing signs of value: mortgage REITs.

I wrote earlier this year that mortgage REITs as an asset class were trading at some of the steepest discounts to book value in history. Well, as we round out the first quarter, very little has changed on that front. Even as earnings and revised book values have come in, valuations haven’t changed much.

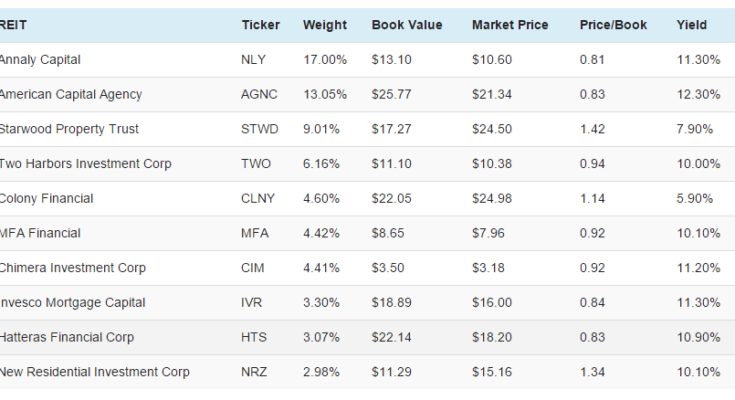

Consider the chart above, which details the top ten holdings of the iShares Mortgage Real Estate Capped (REM). The mREIT universe is small, and the top ten holdings make up 68% of the total portfolio. Two mortgage REITs alone—Annaly Capital (NLY) and American Capital Agency (AGNC)—make up about 30% of the portfolio.

We see a common theme throughout the top ten holdings. This is one of the few remaining truly high yield corners of the market, and the top ten holdings have a weighted average yield of 10.4%.

But what interests me more are the large discounts to book value. The top ten holdings trade for 97 cents on the dollar. But Annaly and American Capital Agency trade at even deeper discounts, 81 cents and 83 cents on the dollar, respectively.

Let me put this into perspective. You could hypothetically buy up all of the shares and close the two mortgage REITs, selling their assets as spare parts, and still make a respectable profit of 19% and 17%, respectively.

The market seems to be pricing in major capital destruction by their respective managements. But is that fair? Annaly in particular has a long operating history, and it has survived every conceivable bend and twist in the yield curve over the years.Granted, our situation today—one in which short-term rates are at zero and mortgage rates near all-time lows—is unprecedented. But at these discounts to book value, the market is practically gift wrapping a massive margin of safety for us.