Many of my recommendations to The Dividend Hunter subscribers are companies that are very lightly followed by the financial media, if at all. I have found that a very large portion of the individual stock coverage focuses on a very small number of stocks. This applies whether you are looking at blue chip stocks, new technology companies or investing for yield. Following the lesser-known stocks has many advantages that can boost your portfolio’s returns.

Sometimes the market “discovers†one of these really good companies that the majority of stock investors have overlooked. A discovery usually results in a very nice share price gain as the money begins to flow in. That has happened to two Dividend Hunter recommendations over the last six weeks, and I believe that this same “discovery†is about to happen with another of my recommendations.

Undiscovered high-yield stocks generally yield quite a bit more than similar companies that more investors know about and own. When a dividend paying stock moves into the market limelight, the share price will rise until the yield looks more like other stocks with similar business operations. The two stocks that have jumped recently are finance REITs, providing financing or debt capital into unique sectors of the commercial real estate markets.

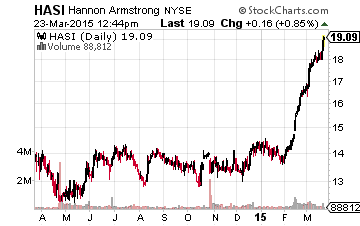

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE:HASI) provides financing for renewable and energy efficiency projects. HASI came into the market with an April 2013 IPO. Although the company early on (I recommended it to subscribers in August 2014) showed the potential for 10% or better annual dividend growth, the market priced the shares to keep the yield in a 6.5% to 7% range. It took an early February 2015 article by REIT guru Brad Thomas to open the market’s eyes about HASI. Since the end of January, the HASI share price has gained 38%.

New Residential Investment Corp (NYSE:NRZ) is a REIT that operates in the not well-known world of mortgage servicing rights and mortgage servicing advances. These investments support the mortgage industry by providing capital to companies that service existing mortgages. Since its May 2013 spin-off from Newcastle Investment Corp (NYSE:NCT), NRZ has carried an 11% yield. This is in spite of paying both growing and special dividends. On February 23, New Residential announced it would acquire the only other pure-play company in the mortgage servicing finance space, putting the company on the investing public’s radar. The NRZ share price is up 18% in the last month and the yield is now below 10%.