by Seth Mason, Solidus Center

Recently, two prominent Republicans, Banking Chairman Richard Shelby of Alabama and House Financial Services Jeb Hensarling of Texas, stated that they plan to explore proposals that would roll back a long-standing provision that gives the president of the New York Federal Reserve an automatic position as vice chairman of a powerful committee that oversees Wall Street banks.

Not surprisingly, long-time New York Fed President-and long-time Goldman Sachs executive-William Dudley has vehemently opposed criticisms that his branch of the Fed has given Wall Street banks a pass on improprieties, once brazenly stating at a congressional hearing that he doesn’t believe that anyone should “question his motives”. However, as the fallout from former Fed whistleblower Carmen Segarra’s secret recordings of New York Fed meetings has demonstrated, Dudley’s Fed not only realizes that it gives Wall Street banks relative impunity, but it will threaten anyone who questions its lax oversight.

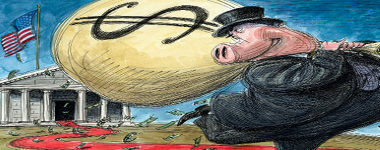

Many high-ranking Fed officials, including former Chairman Ben Bernanke, current Chairwoman Janet Yellen, and the aforementioned William Dudley, purportedly oppose an audit of the Fed because doing so would undermine the “independence” of our nation’s central bank. However, given the preponderance of empirical data (scroll down to the charts section) and testimony from Wall Street insiders that demonstrate that the Fed enriches Wall Street at the expense of Main Street, Segarra’s damning recordings, and the fact that the past four New York Fed presidents have been Wall Street bank executives, one can reasonably conclude that the Fed and Wall Street are, in fact, in cahoots. It stands to reason, then, that the powers-that-be at the Fed would oppose an audit not because it would undermine its so-called independence, but rather because it would expose the incestuous relationship between our nation’s central bank and Wall Street elites.